Business – Manufacturing – Vertical Industries

From a personal standpoint, reviewing an ending year always makes people go through the lens of experiences – sad or happy – peaks, and trials in their life. That is the reason why, we never or rarely have a unanimous answer. From a professional standpoint and in science (technology) especially, there is often a set of trends that the majority of professionals agree on.

Like most industries, the Additive Manufacturing industry has been no exception to the changes and disruptions caused by the pandemic. While the trends we predicted at the end of 2020 were mostly spot on, there are other trends that stood out from the crowd, making us envision other growth routes for 3D printing/Additive Manufacturing.

In this column, we have categorized the main trends that marked 2021 into three: Business, Manufacturing and Vertical Industries.

Business: Career Moves, Mergers & Acquisitions, IPOs vs SPACs

First thing we should note is that 2021 saw a lot of career moves within Additive Manufacturing companies that were trying to find the right balance on the heels of the pandemic. The pandemic urged AM companies to create a new environment and modus operandi for their employees, an environment that requires to take into account DEI objectives and remote work. For other companies, it was about establishing a new management team that would help them get through this pandemic without too much damage.

That being said, “mergers & acquisitions” (M&A) that were the last trend in our review of 2020 happened to be the first trend that we noticed early at the beginning of 2021. With 53 acquisitions (including SPACs) recorded throughout the year – the biggest number ever reported since AM has been recognized as a true industry -, it’s fair to say 2021 was a year of consolidation. Yet, acquisitions and mergers are nothing new in the additive manufacturing arena. Remember, mergers really propelled the industry’s initial boom in the first place.

The thing is, ten years ago, mergers were driven by the potential consumer 3D printing inspired to companies like Stratasys and 3D Systems (these were the leading companies that acquired others to secure a leading place in the industry at the time). This year on the other hand, consolidations have been marked by companies that were initially looking for more financial resources to thrive. These mergers also stressed out the potential of AM to advance industrial production needs. From 3D printer manufacturers to material producers and AM applications companies, some acquisitions were expected, others were quite surprising. Stratasys, 3D Systems, and Desktop Metal are the organizations that led the M&A game this year – with the highest number of acquisitions reported. Interestingly, unlike other companies that have only acquired other SMEs, 3D Systems gave with one hand and took away with the other. Beside this, one of the most surprising acquisitions we witnessed is the acquisition of ExOne by Desktop Metal– yet it’s one that could constitute a real powerhouse marriage for binder jetting.

On another note, the business perspective also reveals that a great number of companies went public this year through SPACs or IPOs. Interestingly, going public via a SPAC has been more appealing for AM companies than going public via the conventional IPO process. 9 companies went public via a SPAC process against 7 for the traditional IPO process (Statistics of September 2021).

We attempted to understand the world of stock markets that AM companies are entering and this preference for SPAC processes. We found out that the attraction goes both ways: tech companies are currently the preferred target for most SPACs and high growth AM technology companies are also looking for a way to go public.

Not to mention that, AM being from the very beginning a disruptive technology, founders and executives who are at the heart of such companies are likely to be attracted by unusual yet disruptive mechanisms like SPAC mergers, to go public.

We have dedicated an exclusive feature to this process, its advantages, disadvantages and the call to remain cautious.

Manufacturing

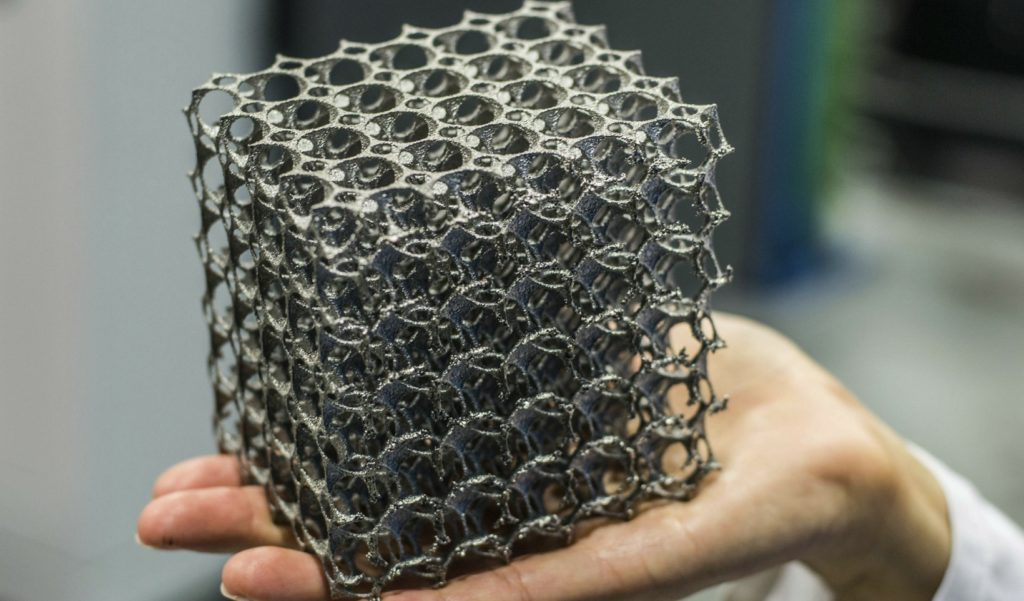

Metal 3D printing has always been the category that has driven the growth of the additive manufacturing market. It’s hard to confirm it in this review when we know that this year was really tough on metal 3D printing companies. The truth is, aerospace is one of the key vertical industries that leverage metal AM technologies the most and this is the vertical industry that has been severely impacted by the Covid-19 pandemic.

As a matter of fact, since December 2020, there has been a wide open debate about how this long-standing revenue-generating industry will completely get back on track when looking at aircraft manufacturing, the supply chain and aftermarket support businesses.

It eventually managed to find a way out of this mess, but it was not enough to remain at the top of manufacturing processes that have been leveraged in AM applications, at the top of manufacturing processes that have been sold this year.

However, we should recognize the steadiness of polymer AM and the ability of players in this field to make strides where we do not expect.

Apart from leading companies like 3D Systems, Sintratec and Sinterit are often the first names that come to professionals’ mind when it comes to exploring SLS technology. We should recognize other players’ efforts here to secure a booster seat around the international table. Here, our thoughts go to the Sweden-based company Wematter that secured a financial round, enhanced its SLS 3D printing package at the software and manufacturing levels, and continuously expands to new markets.

Nexa3D has not been left behind. While the hype has been made on the company’s first desktop 3D printer based on its proprietary lubricant sublayer photo-curing (LSPc) technology, it should be noted that the 3D printer manufacturer has developed a QLS 350 selective laser sintering (SLS) system that can achieve a speed of eight liters per hour at 20 percent job density.

As we mentioned Nexa3D’s LSPc technology, we can’t dwell on this topic without highlighting the need to watch players that ambition to make photopolymer AM an ideal candidate production for end-use applications. With Carbon, we saw some really cool examples in the sports industry, but I would say Azul3D, Axtra 3D, dp polar and Cubicure are other companies to watch in the field.

Surprisingly, the manufacturing area also saw the rise of Wire-Arc Additive Manufacturing (WAAM). Let’s remember that the first patent for this technology was granted in the 1920s, which means it is one of the oldest AM processes that exist. Yet, the technology is the least known among recognized AM processes. We conducted a thorough investigation on the reason for this slow adoption, and it turns out that the key to success may lie in the gap that still needs to be fulfilled in the supply-chain. However, apart from these areas for improvement, this year WAAM has demonstrated its ability to deliver efficiency in industries that are likely to propel the growth of AM. With interesting and real case applications shared in the heavy industries, oil, gas & maritime sectors as well as energy, WAAM can hold its own in the aforementioned segments and deliver a real business value proposition to any manufacturer that wants to make it its core business.

On another note, just as it is impossible to talk about manufacturing without talking about metal 3D printing, it is quite impossible to talk about manufacturing without a word for FDM 3D printing.

The most widely-used AM process across industries has been marked by the increasing interest of FDM 3D printer manufacturers in metal FDM 3D printing. That’s a trend that will continue to gain momentum throughout 2022. Forward AM, the AM brand of BASF, may have created a real hype around metal FFF printing when it released its first metal filament two years ago, and another one last year, but let us not forget that it’s been over 6 years that companies like Virtual Foundry have been exploring and developing solutions to make metal 3D printing accessible through metal FFF.

Other companies debuted in metal FFF printing this year: 3D printer manufacturer BCN3D that announced a “Metal Pack” that can be attached to their Epsilon line of printers to enable extrusion of BASF’s Ultrafuse metal filament and 3DGence that launched their ELEMENT line of BME printers, alongside their own metal filaments.

Speaking of materials, apart from metal filaments that will expand in 2022, the materials segment is a category that will always evolve as the growth is driven by customers who want to achieve specific applications.

As for software, the market is currently advocating open software platforms that will help manage the entire range of AM operations engineers have to conduct for parts manufacturing. While Stratasys latest developments with its GrabCAD® AM platform is not a surprise, there is a bunch of startups that provide solutions that are worth following in the field: Oqton, Authentise, or Additive Flow are a few names we will keep in mind here.

Vertical Industries

As we close the manufacturing segment to focus on verticals that stood out in 2021, it is hard not to highlight the growing importance of sustainability in all aspects of manufacturing. The truth is, sustainability on its own constitutes an entire “category” or “segment” of this industry since it can be tackled on multiple fronts.

We have dedicated an entire edition of 3D ADEPT Mag to this segment. The topic was already a key trend in 2020 as companies are increasingly aware of the need to rethink their business model or manufacturing journeys to meet climate goals. The subject was on the agenda this year and will continue to impact on business actions next year. In the meantime, let’s recognize Sherry Handel’s efforts to encourage companies to take action in this journey as part of AMGTA. The Additive Manufacturer Green Trade Association has welcomed 22 organizations this year, has granted a $100,000 gift to Yale to fund AM life-cycle assessment research and has announced its first Life-Cycle Assessment Research Project for Additive Manufacturing.

It has not only been a busy year for AMGTA. Other companies have achieved applications that take into account sustainability and circular economy needs, but the hardest part so far is being able to quantify them. We believe this is the road we will be heading down most next year: discovering data that reveal how sustainable technologies and applications are.

As far as vertical industries are concerned, for some reason, we were sure that automotive, medical & healthcare would have been the verticals that we will talk about the most in this review. It turns out that despite the advancements in these verticals – especially in terms of battery cells and electric vehicles in the automotive area -, the verticals that made the greatest strides this year are food 3D printing and construction 3D printing.

With the many projects that are being held across the world right now, be it in the USA, Germany or UAE, the global 3D printing construction market could be on the right path to grow from USD 3 million in 2019 to USD 1,575 million by 2024, at a CAGR of 245.9 % between 2019 and 2024.

Several companies have decided to specialize in the field, both companies that are coming from the conventional building industry and technology companies that have been providing construction 3D printing services since day one. No matter what background they have, these companies have decided to address a challenge common to all regions (Africa, USA, Europe, Asia): the housing shortage.

As for food 3D printing, the segment is undertaking a real change as there is a growing use of 3D printing for applications that go beyond the aesthetic purpose. In 2021, this vertical saw the development of alternative meat 3D printed products – some of them already available in select restaurants -, vitamins, and 3D printed fish.

Sales of plant-based meat for example, grew 45 per cent over 2020 and this niche is now worth $7 billion. Names that we will remember here include Redefine Meat, MeaTech, byFlow, and SavorEat to name a few.

And now…?

It can be overwhelming to reflect on a year that is ending, trying to bring out the key highlights and to determine what will shape the coming year. There may have been some developments or sectors of activity that were not mentioned, and this is not necessarily because they have not evolved…In the end, the degree to which these trends have affected the industry varies from one geographical region to another or from one vertical to another…

Until now, for the entire 3D ADEPT Media Team, heading to Formnext 2021 in Frankfurt – after almost two years of virtual events, and what seemed to be endless lockdowns – to connect and reconnect with new and old faces of this industry will remain the highlight of the year 2021 for us.

This content has first been published in the 2021 November/December edition of 3D ADEPT Mag.

Remember, you can post job opportunities in the AM Industry on 3D ADEPT Media free of charge or look for a job via our job board. Make sure to follow us on our social networks and subscribe to our weekly newsletter : Facebook, Twitter, LinkedIn & Instagram ! If you want to be featured in the next issue of our digital magazine or if you hear a story that needs to be heard, make sure you send it to contact@3dadept.com