An attempt to understand the world of stock markets that additive manufacturing companies are entering.

Even though the Covid-19 pandemic has expedited the use of AM across various manufacturing fields, it should be noted that beyond these industries, there are financial markets that are often vitally linked to economic performance. Indeed, the influence of financial development on economic growth is one of the most challenging research questions that macroeconomists and financial economists had and still have to discuss. Yet the reality of our industry reveals that the number of AM companies going public via mergers with Special Purpose Acquisition Companies (SPACs) rather than conventional Initial Public Offerings (IPOs) is increasingly growing.

- How do SPACs work?

- Why do AM companies prefer SPACs mergers over IPOs?

- And the call to remain cautious…

August 27th, 2020. Additive Manufacturing Company Desktop Metal became the first company of this niche industry to announce to agree to a reverse merger with special purpose acquisition company (SPAC) Trine Acquisition Corp and global credit investment firm HPS Investment Partners; an announcement that has officially been sealed and confirmed on December 2020.

On the heels of Desktop Metal, other AM companies follow the “SPAC” merger route to access the stock market. The first observation, one can all make, is that, beyond the SPAC IPO trend, such mechanisms happen to be a funding opportunity for AM companies that are going down these routes.

| AM Companies | SPAC Company | Projected Post-SPAC Value | Expected Funding Raised |

| Desktop Metal | Trine Acquisition Corp | $2.5 billion | $575 million (raised) |

| Markforged | one | $2.1 billion | $425 million |

| VELO3D | JAWS Spitfire Acquisition Corp. | $1.6 billion | $500 million |

| Shapeways | Galileo Acquisition Corp. | $410 million | $195 million from Galileo and $75 million from a private investment in public equity (PIPE) |

| Rocket Lab To go public in H2 2021 | Vector Acquisition Corporation | $4.1 billion | $320 million from Vector Acquisition and $470 million from a PIPE |

| Fathom | Altimar Acquisition Corp. | $1.5 billion | $80 million |

| Bright Machines (Software company)- to go public in H2 2021 | SCVX Corp. (NYSE: SCVX) | $1.6 billion | Up to $435 million |

| Redwire Space – to go public in H2 2021 | Genesis Park (NYSE: GNPK) | $615 million | N/A |

| Fast Radius – To go public in Q4 2021 | ECP Environmental Growth Opportunities Corp. | $1.4 billion | $345 million |

However, apart from the SPAC-IPO trend, one should give kudos to those AM companies that went public without any fusion with a third-party company.

| AM Companies | IPO Market | IPO Share Price | Valuation at IPO | Expertise |

| Massivit 3D (MSVT) | Tel Aviv Stock Exchange (TASE) | $870 | $203.6 million | Manufacturer of large-volume 3D printing systems |

| MeaTech 3D (MITC) | NASDAQ | $10.30 | $1.1 billion | Food-tech start-up that specializes in 3D printed cultured meat production |

| Norsk Titanium (NTI) | Euronext Growth Oslo Exchange | $1.19 | $326.3 million | Producer of aerospace-grade, 3D printed structural titanium parts |

| Xometry (XMTR) | NASDAQ | $44 | $2 billion | Online AI-enabled marketplace for on-demand manufacturing |

| Freemelt (FREEM) | Nasdaq Stockholm AB. | $1.15 | $ 9 806 569 | Metal 3D Printer Manufacturer |

| Rokit Healthcare (expected for H2 2021) | Korean Stock Exchange | To be announced | To be announced | Bioprinting company |

But what is a SPAC and how does it work?

“Generally, a SPAC is formed by an experienced management team or a sponsor with nominal invested capital, typically translating into a ~20% interest in the SPAC (commonly known as founder shares). The remaining ~80% interest is held by public shareholders through “units” offered in an IPO of the SPAC’s shares. Each unit consists of a share of common stock and a fraction of a warrant (e.g., ½ or ⅓ of a warrant)”, a PwC report reads.

This means that those companies have no operations or business plan other than to acquire a private company using the money raised through an IPO, thereby enabling the latter to go public quickly.

As far as shares are concerned, it should be noted that founder shares and public shares present similar voting rights. However, founder shares have the exclusive right to elect SPAC directors. Warrant holders generally do not have voting rights and only whole warrants are exercisable.

Furthermore, as mentioned earlier, private companies that are going down the SPAC merger route often benefit from a funding opportunity.

Helen Boyle & William Samengo-Turner, senior associates at law firm Allen & Overy LLP explain: “SPACs offer young and fast-growing tech businesses seeking a listing an alternative to the traditional IPO. Many will not have the credentials of a traditional IPO candidate, possibly being unable to deliver the kind of long-term financial and operating track record traditionally expected of a successful IPO. They may be in the very early stages of development, looking for ways to finance the research and development programmes that their future success depends on, and are certainly likely to be pre-profit and in some cases pre-revenue (unusual on a traditional IPO)”.

Why do AM companies prefer SPACs mergers over IPO?

According to financial experts, tech companies are currently the preferred target for most SPACs. Interestingly, one could say the attraction goes both ways as high growth AM technology companies are also looking for a way to go public.

Another way to explain this attraction can be the fact that AM being from the very beginning a disruptive technology, founders and executives who are at the heart of such companies are likely to be attracted by unusual yet disruptive mechanisms like SPAC mergers, to go public.

Just like conventional manufacturing processes are described as time-consuming and expensive in certain cases, AM companies might see in SPACs mechanisms a rapid and cost-saving process.

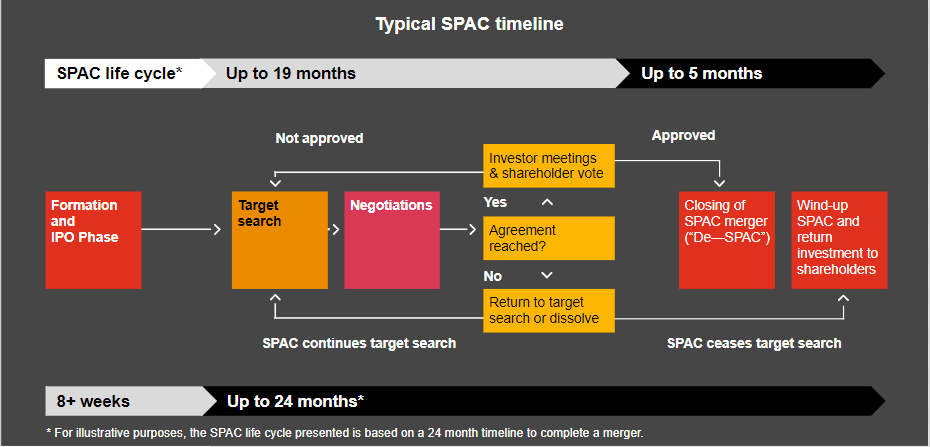

Experts from PwC explain that a SPAC lifecycle can occur on a 24-month timeline to complete a merger.

“Following the IPO, proceeds are placed into a trust account and the SPAC typically has 18-24 months to identify and complete a merger with a target company, sometimes referred to as de-SPACing. If the SPAC does not complete a merger within that time frame, the SPAC liquidates and the IPO proceeds are returned to the public shareholders.

Once a target company is identified and a merger is announced, the SPAC’s public shareholders may alternatively vote against the transaction and elect to redeem their shares. If the SPAC requires additional funds to complete a merger, the SPAC may issue debt or issue additional shares, such as a private investment in public equity (PIPE) deal”, they point out. For this reason, “under the rules governing them [see the table below], SPACs must identify firms they can merge with within 24 months after they have raised their funds or they will be wound up and the IPO proceeds returned to investors”, Ivana Naumovska, lecturer at INSEAD, a business school with campuses in France, Abu Dhabi and Singapore notes.

While the advantages seem very appealing for private companies, it should be noted that such process also raises its share of disadvantages. The table below features a list of pros and cons that companies should be aware of – a list of items that has been established in comparison with IPO’s advantages and disadvantages:

| Going public with a SPAC – advantages | Going public with a SPAC—disadvantages |

| Faster execution than an IPO “A SPAC merger usually occurs in 3–6 months on average, while an IPO usually takes 12–18 months.” | Shareholding dilution: “SPAC sponsors usually own a 20 percent stake in the SPAC through founder shares or “promote,” as well as warrants to purchase more shares. SPAC sponsors also benefit from an earnout component, allowing them to receive more shares when the stock price achieves a specified target over a certain timeframe which could lead to further dilution.” |

| Upfront price discovery: Your IPO price depends on market conditions at the time of listing, whereas you negotiate the pricing with the SPAC before the transaction closes—which is much more advantageous in a volatile market. | Capital shortfall from potential redemption: Initial SPAC investors may redeem their shares. If redemptions exceed expectations, then cash availability becomes uncertain and forces SPACs to raise PIPE financing to fill the resulting shortfall. |

| Funding opportunity | Compressed timeline for public company readiness: Although the SPAC sponsor may offer help during the merger process, the target company usually takes the brunt of preparing for required financials in the SEC filings and establishing public company functions, such as investor relations and internal controls, under a much shorter deadline than in an IPO. |

| Less marketing resources: “A SPAC merger doesn’t need to generate interest from investors in public exchanges with an extensive roadshow (although raising PIPE involves targeted roadshows).” | Financial diligence performed at narrower scope: The SPAC process does not require the rigorous due diligence of a traditional IPO, which could lead to potential restatements, incorrectly valued businesses or even lawsuits. |

| Access to operational expertise: (AM) private companies can benefit from their SPAC sponsors’ experience in finances and management | Lack of underwriting and comfort letter: In a traditional IPO, the underwriter makes sure all regulatory requirements are met but because a SPAC is already public, the target company doesn’t have an underwriter. |

We are just halfway through the year…be cautious.

We are just halfway through the year and 2021 has already seen some massive valuations of newly public companies, companies that do not only operate in the AM arena. No matter what route (SPAC or IPO) they take, the primary advantage to go public for AM companies is the potential to grow their company exponentially with much-needed cash.

While we cheer with AM companies that have embraced this route, we can’t help but fear an “IPO crisis”. Far be it from us to be birds of ill omen but the fact is, there was a time when interest in technologies has spiked and fallen during the mid-2010s.

When asked if this might happen with AM technologies, Arno Held, Managing Partner at AM Ventures Management GmbH, did not and could not provide a definite response, yet remains encouraging:

“Our planet and our society are faced with massive challenges. If we want to make the transition to a sustainable civilization, we must adapt our ecologic and economic behavior. Changing our consumption means that products must change which means that production must change. We must avoid waste, increase the lifespan of products and reduce the distances that products have to travel as physical goods. All these challenges are addressed by digital manufacturing in general and Additive Manufacturing technologies very specifically.

On AM Ventures’ tech radar which identified more than 600 AM startups in 2021 alone, we can see that half of the AM companies founded this year are applications companies. This is an entirely new trend since we have started monitoring startup activities more than 7 years ago and means that we have finally learned how to use AM technologies and apply it in order to revolutionize how products are developed, produced and distributed.

Of course, markets are performing in cycles which are sometimes bearish and sometimes bullish. The overall trend, though is very encouraging and we are only just at the beginning of the digital manufacturing age”.

Furthermore, another key point we will keep in mind is that, although these publicly-listed companies benefit from “enough” cash to fund operations and ensure their future growth, one cannot legitimately say that SPAC acquisitions guarantee profitability or the success of a company.

As per the words of Held, “profitability and success are never granted in business. They are much rather the result of extremely hard work in the right market, at the right point in time, with a sound business model and done by the right team of individuals. Still, all these factors can only increase the likelihood for success but will never give a 100% guarantee.”

Moving forward, AM just starts to be the talk of the markets. This newfound interest will not fade anytime soon. So, if you are a publicly-listed company, do not lose track of your vision and use the cash wisely, if you are not a publicly-listed company, take advantage of the media hype it continuously provides to AM technology in general, and make your best deal out of it. In any case, the progression from early-prototyping applications to end-use (mass) production becomes more and more tangible.

This exclusive feature has first been published in the 2021 July/August issue of 3D ADEPT Mag. Remember, you can post job opportunities in the AM Industry on 3D ADEPT Media free of charge or look for a job via our job board. Make sure to follow us on our social networks and subscribe to our weekly newsletter : Facebook, Twitter, LinkedIn & Instagram ! If you want to be featured in the next issue of our digital magazine or if you hear a story that needs to be heard, make sure you send it to contact@3dadept.com