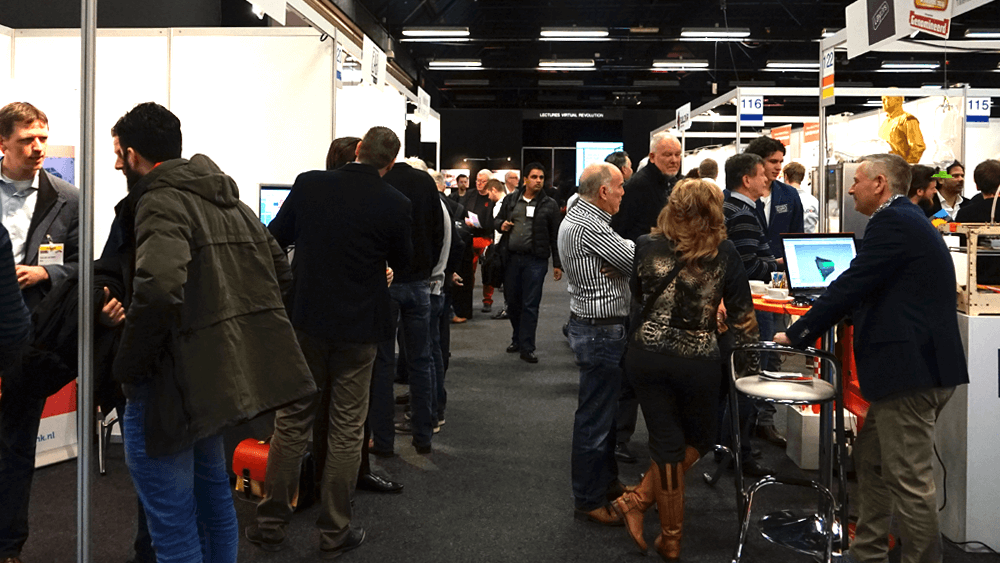

The 9th edition of RapidPro has closed its doors on March 14th. On March 13th and 14th, mikrocentrum, the organizer, has welcomed 80 exhibitors and 2200 visitors that comprised a diverse palette of professionals on the Dutch Market (Eindhoven).

Speaking with Tom Wessels, Event Manager of the show and a few exhibiting companies, we were able to understand what attracts this variety of profiles on the one hand, on the other hand, the positioning of the Dutch market in the manufacturing industry in general.

The reasons why RapidPro distinguishes itself from other events

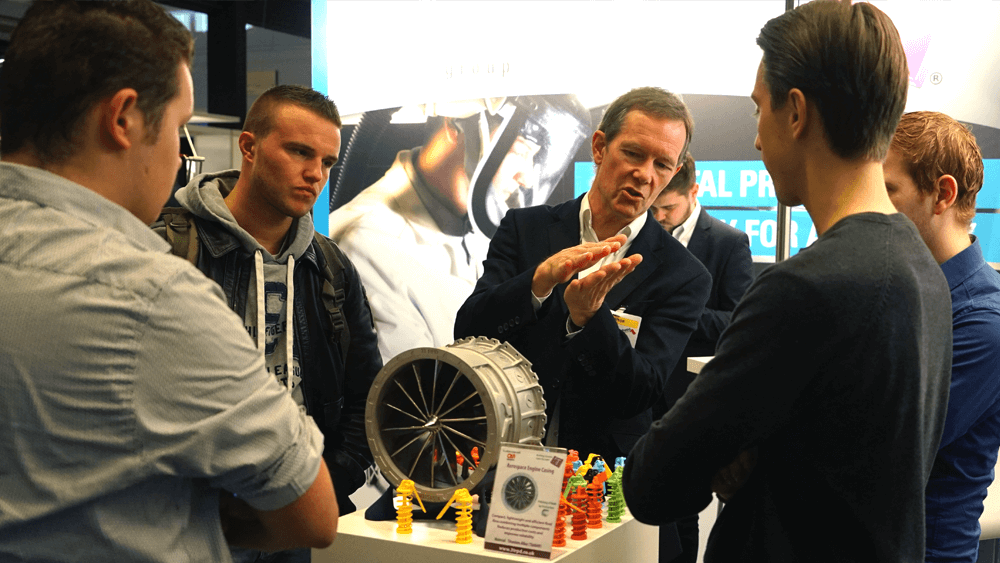

The statistics of the show might reveal a small exhibition if it is compared to other manufacturing events organized in European countries such as France or Germany. However, according to Tom Wessels, this 9th edition shows the applications of digital manufacturing in a broad sense. In addition to demonstrating a general development of additive manufacturing (AM), RapidPro follows the industry trends towards maturity and is able to offer an array of solutions that covers the whole value chain.

Indeed, the palette of exhibiting companies demonstrates a wide range of technical solutions for prototyping, product development, customization as well as rapid, low volume & on demand production. Furthermore, the event relies on the support of Flam3D, an independent platform for all stakeholders of the Additive Manufacturing Industry, and TNO, the Netherlands Organisation for applied scientific research, to provide professionals with accurate knowledge regarding the implementation of digital manufacturing techniques. In this light, these two organisations conducted a certain number of conferences during the event.

A focus on Belgium and The Netherlands

Early beginnings of RapidPro showed a unique focus on the Dutch market when industrial production of this market showed a growth rate of above 3%. Over time, globalization of activities has led to a natural opening to international companies. “Although we observe a few exhibiting companies from the German market, current statistics show that the exhibition remains 70% focused on Belgium and the Netherlands”, explained Tom Wessels.

This willingness to develop the industry of these two “brother countries” results in various advantages; the first one being the high level of networking the exhibition features. A blatant example was the “Meet & Match” sessions co-organised by the Dutch Chamber of commerce. It goes without saying that the need to exchange on real and concrete projects is a “must” for exhibiting companies. That’s why conversations between visitors and exhibitors have been prepared prior to the event to enable efficient follows both for visitors and exhibitors. With the support of the Dutch embassy in Belgium, a group of Belgian visitors has therefore been able to meet various exhibitors and discover the solutions provided by exhibitors.

The key role of distributors for manufacturers of 3D printers & materials suppliers

To get into a market such as the Netherlands, it is crucial for manufacturers to be supported by distributors. Distributors are certainly a great deal for a producer that wants to avoid cultural and language barriers that might arise in business but their presence reveals a more prominent need: the need to ensure a reliable customer service.

MakerPoint, Mark3D, 3DshopNL, AMR europe and Multi 3D Print may be all distributors but each of them has a unique strategy to embrace the market.

MakerPoint

We have heard about MakerPoint for the first time after a partnership the distributor signed with miniFactory and KIMYA. Sander Smit, the owner explained us that they are active in 5 locations in The Netherlands: Arnhem, Eindhoven, Harlingen, Utrecht and Rotterdam.

The company supplies consultancy services, 3D printing services and training. Their customers range from design & engineering offices to dental laboratories and aerospace companies, and according to the owner, these customers mostly require prototyping services when it comes to production. Sander Smit laid emphasis on the fact that although he is very selective in the choice of his partners, “the overlap between solutions is not that big”. However, as per the owner’s words, the key to foster the development of the market is to ensure “training and maintenance”.

Mark3D

Mark3D is uniquely positioned on this market as the company strives to change the way manufacturers produce by only providing Markforged’s technology; “an unusual strategy but one that has paid off so far”, according to Charlotte van Rosmalen, Marketing & Inside Sales Mark3d Benelux.

Charlotte van Rosmalen explained that unlike other countries like Germany and the UK where they also have offices, this strategy is particularly interesting for The Netherlands because “professionals aren’t yet convinced by the technology.” Therefore, the focus on one technology in which they believe, is important to avoid information overload and to better support the consumer.

One should also note that this strategy can only attract professionals that are looking to achieve applications with metal AM.

AMReurope

Acknowledged as one of the biggest distributors of the Dutch market, AMReurope supplies a wide range of 3D printing technologies and materials. Only active in The Netherlands, Stefan Stoks and Dennis Kloezeman believe that 3D Printing is not a “future tech anymore” but there is still a long way to go to foster the adoption of the technology on the market as many people still do not know what 3D Printing is. This assertion might be difficult to believe from inner players when one knows that the Netherlands is one of the main European players of the 3D printing industry and that the consulting firm Berenschot has estimated the Dutch 3D printing market at 120 million euros in 2017, in other terms, a 20% growth compared to 2016.

3DshopNL and Multi 3D Print

Lastly, 3DshopNL and Multi 3D Print are two distributors that started their business at the local level and thereafter decided to expand it at the national level in order to cover a wide range of regions. 3DshopNL provides the market with professional 3D printers whereas Multi 3D Print mainly focuses on large format 3D printing supplying Massivit 3D Printing technology.

In a nutshell, various industrial manufacturers were represented, from industrial manufacturers like Renishaw, Trumpf, 3D Systems, Rosler to manufacturers of professional 3D printers like dddrop. At the software level, software companies like MsC Software and Altair unveiled their latest solutions. As far as the manufacturing industry is concerned, the event kept its word by unveiling an array of solutions that can be exploited throughout the whole value chain. However, given the quality and the profile of exhibiting companies, it also demonstrates that 3D printing is only highlighted as “part of the solutions of a production workflow”.

For further information about 3D Printing, follow us on our social networks and subscribe to our newsletter

Would you like to subscribe to 3D Adept Mag? Would you like to be featured in the next issue of our digital magazine? Send us an email at contact@3dadept.com

//pagead2.googlesyndication.com/pagead/js/adsbygoogle.js (adsbygoogle = window.adsbygoogle || []).push({});