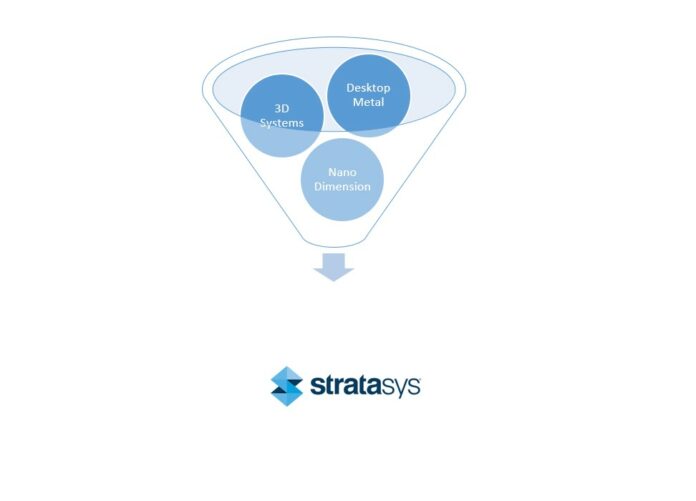

An unexpected big player has joined the “merger dancing floor” of Stratasys: 3D Systems. With an offer of $7.50 in cash and 1.2507 newly issued shares of common stock of 3D Systems per ordinary share of Stratasys, 3D System’ unsolicited non-binding indicative proposal would potentially represent $1.225 billion. This is less than the total $1.8 billion estimated for the merger with Desktop Metal.

The announcement follows another rejection of Nano Dimension’s partial tender offer to acquire Stratasys. Stratasys recalled in the press release announcing this unsolicited proposal that entered into a merger agreement with Desktop Metal and that it will review this proposal in accordance with its fiduciary duties, and its obligations under this merger agreement, in consultation with its independent financial and legal advisors.

One thing seemed clear: if Stratasys merges with Desktop Metal, it would dilute Nano Dimension’s shares purchased on the open market, which accounted for about 14% ownership of Stratasys and gave it leverage in its attempted buy-out.

Here is the thing, the transaction is only expected to be completed in the fourth quarter of 2023 as it is still subject to customary closing conditions, including the approval of Stratasys’ shareholders and Desktop Metal’s stockholders and the receipt of certain governmental and regulatory approvals.

This means anything can happen from now and in the meantime, speculation is well underway within our industry where there is never a dull moment.

An unclear strategy for all stakeholders involved

So:

- Yes, Stratasys + Desktop Metal could be an interesting combo. Manufacturing wise, it could lead to a growth on materials, a deep dive into metals within Stratasys, the establishment of one of the largest AM service bureaus ever (hint: a previous interview of 3D ADEPT (3DA) Media with Desktop Metal’s Chief Product Officer) – which means we will likely see 👉 further acquisitions in the near future.

- Business wise, as I said here, this might raise a number of unanswered questions: will all these business units/subsidiaries acquired by these giants be able to evolve healthily? – Because, yes, if Stratasys buys DM, it would also be the owner of all the companies the latter acquired so far. But, you have to admit that, at the end of the day, many of the companies acquired provide the same solutions and I doubt that customers will always have enough budget for all of them.

On another note:

- Yes, 3D Systems + Stratasys would make a gigantic giant – just imagine the number of patents that would come under one single roof. Is it not going kill several other companies?

- On a more personal note, it might seem logic if one only looks at profits but I truly doubt this turns in favour of 3D Systems because its offer is even lower than Nano Dimension’s offer.

According to you, who will have the last dance with Stratasys? DM, 3D Systems, or another potential and unexpected big giant?

Remember, you can post job opportunities in the AM Industry on 3D ADEPT Media or look for a job via our job board. Make sure to follow us on our social networks and subscribe to our weekly newsletter : Facebook, Twitter, LinkedIn & Instagram ! If you want to be featured in the next issue of our digital magazine or if you hear a story that needs to be heard, make sure you send it to contact@3dadept.com