What happens when the numbers don’t match the narrative?

Sabrina Barbera from Epsilon Idea recently drew my attention to the difference between “complicated” and “complex”, and to why some teams succeed where others fail.

Drawing inspiration from management theorists such as Dave Snowden and his Cynefin framework, she explains:

A complicated problem is predictable and analyzable. It has a single solution that can be planned, modeled, and controlled with precision. The problem can be broken down, the results are reproducible if the process is followed, and the path to the solution can be traced in advance.

A complex problem, on the other hand, is evolving and emerging. Its solution does not exist at the outset; it is built gradually through action and interaction. Here, variables constantly change and influence each other. The solution emerges through experimentation and collective learning, requiring continuous adjustments based on feedback.

For some reason, this makes me think about additive manufacturing. What if we looked at the problem from the other side? What if additive manufacturing were a complex problem, one we’ve been trying to solve as if it were merely complicated?

Either way, this distinction feels like a key lesson the additive manufacturing market in 2025 has to teach us.

The adrenaline rush has subsided.

Since Covid-19, the industry has gone through unusual times. Mergers and acquisitions — particularly those involving SPACs — created a wave of companies going public. But soon after, reality hit many of those that had taken that path. This reality has reignited concerns among outsiders about the reliability of additive manufacturing; once again framing it as a technology surrounded by hype and uncertain credibility.

Is that perception accurate? It’s difficult to answer with a simple yes or no.

The truth is that since 2022, additive manufacturing has reinforced the necessity to look beyond its technical aspects — the very aspects that can make outsiders believe in a fairy tale where every story ends well for founders and decision-makers. Behind these technologies are companies that all dream of becoming the next unicorn of the century.

But the reality is that the problem is complex, evolving, and still emerging. And in 2025, the business landscape has reminded us of this through ten key lessons.

1. M&A is here to stay

Thousands of AM companies have emerged worldwide over the past 30+ years. Many of their founders and owners are now looking to exist through M&As. This wave of consolidation, which started in 2022 as a result of the pandemic, is here to stay.

With more than 53 acquisitions (including SPACs) recorded in 2011 — the highest number ever reported since additive manufacturing was recognized as a true industry — we later reported over 21 acquisitions in 2022, more than 24 in 2023, and around 15 in 2024.

In 2025, we reported more than 25 acquisitions across the additive manufacturing landscape. Some companies exited the scene, including 3D Systems’ Systemic Bio and Arburg, while Nano Dimension shut down several of its subsidiaries — Admatec, DeepCube, Fabrica, and Formatec.

While this number might be similar to what was reported in 2023, our assessment reveals that money will continue to be hard to get. The reason is simple: VC firms and investors will scrutinize businesses developing a technology that can go beyond a simple promise. They will need clear markets and a path to scale sustainably.

That said, new joint ventures and relaunches also reshaped the funding landscape in 2025. NUBURU formed a joint venture with Maddox Defense to develop advanced drone systems using AM, Desktop Metal reemerged under the Arc Impact Acquisition Corporation, TRUMPF became ATLIX, and both Admatec and Formatec began a new chapter following their exit from Nano Dimension.

Ten years ago, it seemed natural to witness a wave of acquisitions, given that the industry was still in its infancy. Today, however, these acquisitions are largely driven by the high costs associated with the technology. If they are here to stay, cost — along with time — remains another key point to watch in the business landscape.

| Buyer | Acquired |

| Unannounced | 3D Systems’ Oqton & 3DXpert |

| Sodick | Prima Additive |

| Nano Dimension | Desktop Metal |

| Anzu Partners | ExOne, Voxeljet, EnvisionTEC |

| DyeMansion | ASM |

| Gleason Corporation | Intra Group of COMPANIES |

| SBO | 3T Additive Manufacturing |

| Lumas Polymers | Jabil engineered material assets |

| Caracol | Hans Weber Maschinenfabrik GmbH |

| Pac-Dent | Ackuretta Technologies |

| SprintRay | EnvisionTEC dental portfolio |

| Hexagon | 3D Systems’ Geomagic portfolio |

| AMETEK | Faro Technologies |

| Fortissimo Capital | 14% of Stratasys shares |

| nTop | cloudfluid |

| Quantum | BCN3D |

| LK Metrology | ProCon X-Ray GmbH |

| Stratasys | Select 3D printing assets from Nexa3D |

| Tethon3D | Sintx Technologies |

| Airtech Advanced Materials | Kimya |

| Sandvik | Barefoot CNC, CAD/CAM Solutions, and CamTech Engineering Services |

| Peak Technology | Jinxbot 3D printing |

| Nova | Sentronics Metrology GmbH |

| United Performance Metals | Fabrisonic |

| Synopsys | Ansys |

Figure 1: Table of M&As reported in 2025

2. Time and cost, ongoing challenges in the AM market

Despite the optimism around industrialization, time and cost are still the friction points limiting AM’s broader profitability in 2025.

Our conversations did no longer focus only on the design. Improving production costs and reducing manufacturing costs across the value chain are increasingly considered as primary concerns for AM users. At least, that’s what we learned from this season of Additive Talks.

If the high cost of the technology drives acquisitions, that’s only because the ultimate goal of businesses is to increase the technology viability for a wide range of applications. In the end, is that not what the industry has been needing?

Even as AI and automation reduce trial-and-error in process development, the cost of certifying a new material or part remains steep, especially in aerospace, medical, and energy sectors. Companies still face long lead times for test builds, validation, and documentation.

Time delays also come from fragmented digital workflows. Moving from design to print prep to post-processing often requires navigating multiple software platforms.

That’s why 2025 has seen stronger interest in end-to-end software ecosystems, digital twins, and AI-driven job scheduling; all aimed at cutting lead times and reducing operator input. The partnership between Synera & Materialise is one that’s worth mentioning here as an example.

3. That said, hardware still dominates.

Money is in the hands of machine manufacturers. Financial results reveal that the majority of the revenue of leading AM companies comes from machine sales. Yet, they sometimes provide other services (production services and sometimes, materials).

A few names that have been making headlines this year include 3D Systems, Bambu Lab, BLT, EOS, Farsoon, and HP in the 3D printer area.

Solukon, DyeMansion GmbH, and PostProcess Technologies Inc. are probably the reason why post-processing is increasingly seen as a differentiator and one of the next frontiers for scalability.

4. The decline in service bureaus’ 3D printing segment: another reality check point

With machine manufacturers expanding their offering to production services, we couldn’t help but question the relevance of 3D printing services within service bureaus. We found out that 3D printing remains a tiny part of the business of those who are financially stable.

Looking at the financial results of Xometry and Protolabs, for example, one realizes that AM, although valuable, is not a driver of growth.

In Q3 2025, Protolabs posted record revenue of $135.4 million (up 7.8% YoY), driven by strong gains in CNC machining and sheet metal fabrication, while its 3D printing segment declined 6.3% to $20.1 million, highlighting that additive manufacturing is not fueling growth for service bureaus. Xometry saw similar trends, with overall revenue up 28% to $180.7 million, led by its marketplace division, not by 3D printing.

We’ve long preached that additive manufacturing (AM) is a valuable tool within the broader manufacturing toolbox, not a wholesale replacement for conventional methods. This shift reinforces that view, marking a healthy evolution in how the industry understands and applies AM. It also underscores a key economic reality: companies built entirely around AM will inevitably be smaller and less profitable than those anchored in full-spectrum production.

5. The business opportunity that metal AM brings to the consumer market

While metal additive manufacturing has made its most striking impact in aerospace, defense, and space applications, manufacturers are now uncovering new possibilities for this technology in high-end markets focused on luxury and customization.

Apple’s latest iPhone and Maeve Gillies’s Tùsaire collection are our favorite examples of this year. And that’s just the beginning. We might expect more applications moving forward.

6. All eyes on China: the next frontier for tech and manufacturing

Before looking at the tech side, if we lay and will continue to lay our eyes on China, that’s because Chinese companies receive strong support from their government. In China, startups benefit from tax breaks, streamlined access to supply chains, and government-backed initiatives that level the playing field against global giants.

This stands in contrast to Europe, where launching a business is costlier. While Western policies often emphasize protectionism, China fosters innovation by reducing barriers, creating an environment where additive manufacturing firms can flourish.

While highlighting the “fall and rise” of desktop 3D printing last year, we also anticipated that this trend will follow in 2025. And it did.

2025 saw a big rise in sub-$2.5k desktop shipments (Chinese vendors dominated), driven in part by tariff fears and consumer/SME demand, while mid/industrial machine shipments weakened.

If this bifurcation is affecting channel strategies, it also opened more opportunities to desktop 3D printer manufacturers in APAC. Bambu Lab, for instance, opened a flagship store in Shenzhen, the “Silicon Valley” of the country. As said in this article, this strategy is probably one of the best moves from the company when we know that Formnext Asia Shenzhen 2025 highlighted the growing interest in 3D printer farms, underscoring the relevance of such a store.

While we will not be surprised to see other manufacturers follow, Bambu Lab is setting a precedent for how retail spaces can showcase the power and scalability of additive manufacturing.

Bambu Lab’s flagship store is one example among several. Anisoprint’s story also exemplifies this trend as the company not only established a new HQ in Shanghai, but it also shifted its business model.

7. The prosumer 3D printing segment is one to watch

By choosing to focus exclusively on the consumer 3D printing market, Anisoprint is betting on the growing momentum of consumer & prosumer 3D printing.

With the rise of prosumer 3D printing, more individuals and small businesses are investing in capable desktop 3D printers for real-world applications, bridging the gap between hobby and professional use.

With other desktop 3D printing technologies like SLA often considered, we believe jewelry and fashion designers could be the ones driving the most this segment.

That said, looking through the lens of “complicated” versus “complex” problems, Anisoprint’s move is a typical example of tackling a complex challenge. It wasn’t easy. As a matter of fact, founder Fedor Antonov ultimately decided to step away. Yet, it’s precisely this willingness to navigate uncertainty that underscores the company’s approach to innovation.

8. Defense kept its promise

Last year, we predicted that countries’ Departments of Defense would prioritize spending in applications enabled by AM. This trend happened to be true when we look at the partnerships and applications announced in the field.

Fueled by the need to cut lead times, localize production, and repair equipment amid geopolitical tensions and supply chain disruptions, the defense sector will continue to be a key driver of AM growth next year.

9. Medical & Healthcare: Focus on reimbursement path

Another field that continues to draw significant attention. This year, we went beyond showcasing the usual applications to examine the current state of public policies that enable patients to benefit from 3D-printed implants. With reimbursement for 3D-printed prosthetics already approved in the United States, Europe is now under pressure to advance its own policies and stay ahead of the curve in adopting additive manufacturing technologies.

I have no doubt that organizations such as MgA – Medical goes Additive will foster the right connections to bring this issue higher on Europe’s agenda. In any case, this will remain a key topic to watch in 2026.

10. Sustainability, a European concern?

If you’re a regular reader of 3D ADEPT Media, you already know that we consistently advocate for more data showing how additive manufacturing companies are implementing sustainability strategies within their operations.

Among AM users, semiconductor companies and energy equipment manufacturers are increasingly investing in solutions that help them deliver more sustainable services — from prioritizing eco-friendly materials and energy-efficient processes to designing parts that minimize waste and resource consumption.

This year, the initiatives gaining the most momentum centered on the development and commercialization of recycled materials. While, as we highlighted in the September/October edition of 3D ADEPT Mag, there are other approaches that could significantly drive ESG impact, it’s worth noting that most of the new initiatives announced this year have come from European companies.

A brief assessment suggests that European additive manufacturing companies and users generally place a stronger emphasis on sustainability than their counterparts in the U.S. and Asia, largely due to differences in policy frameworks, consumer expectations, and a broader cultural commitment to environmental responsibility. The U.S. and Asia are making progress, but their efforts often align with other strategic priorities.

Looking through the lens of “complicated” versus “complex” problems, sustainability in AM is a “complicated problem”, one that can be predicted and analyzed with relative ease. Here, it’s all about defining a strategy that can be implemented and monitored over time.

Concluding notes

The AM business landscape does not reflect a single, steady reality that applies to every company. Economic conditions appear greener in some regions — particularly in Asia — but that’s largely because the end goals differ from one company to another.

Looking through the lens of “complicated” versus “complex” problems, this year’s business review reminds us how difficult it can be to distinguish between the two. In practice, most companies are navigating both at once: managing predictable challenges while adapting to evolving ones, which makes it hard to adopt a clear, consistent stance.

Ultimately, success in this landscape often comes down to following where the data leads, rather than holding on too tightly to a vision that may no longer reflect reality.

As we move into 2026, one thing is certain: the companies that will thrive are those that embrace complexity; not as a barrier, but as an opportunity to learn, evolve, and redefine what’s possible with additive manufacturing.

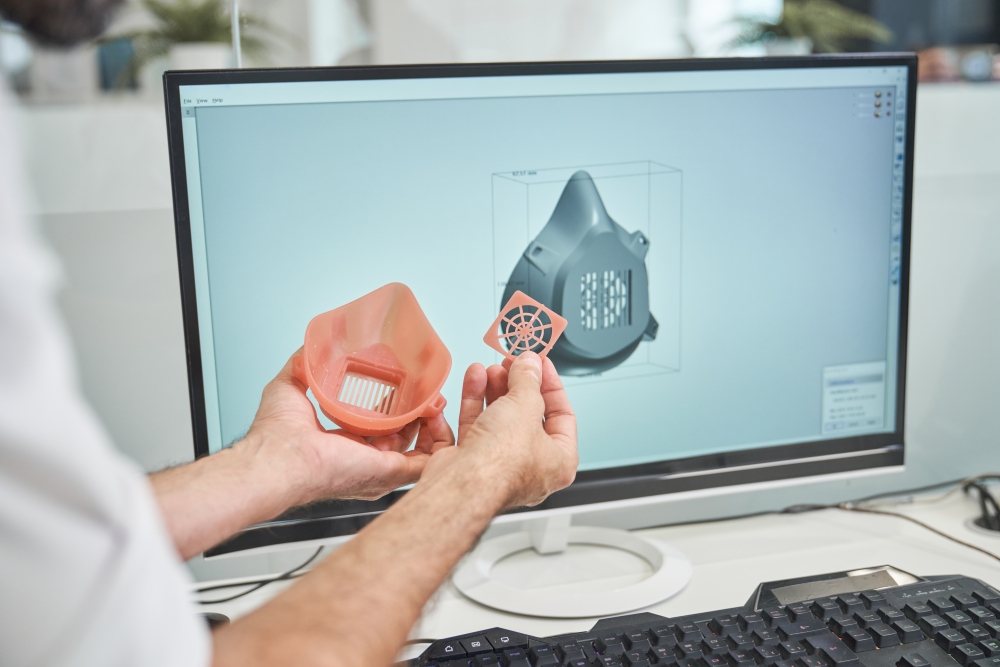

Featured image: 3D ADEPT MAG – Between vision and reality … The state of AM Business in 2025_*We curate insights that matter to help you grow in your AM journey. Receive them once a week, straight to your inbox. Subscribe to our weekly newsletter.