Before starting this “2023 year in review” article, I had a look at what I wrote last year: consolidation through acquisitions & funding dominated the market, materials & software called the tune in the manufacturing value chain, and QA & CT scanning were defined as potential areas of focus for this year.

Then, I made a detailed analysis of this year. And the first thing I realized is that, in many regards, 2023 was a repetition of 2022.

A financially stressful condition

Once more, it was about money. Even when they say it was not, it was about it. Consolidation has continued through strategic acquisitions. This year, we covered over 24 acquisitions – compared to 21 reported last year. Some of these transactional discussions entertained so much that they became a saga whose end results disappointed their audience (cf. Stratasys-3D Systems-Nano Dimension-Desktop Metal).

While shareholders’ profitability becomes hard to guarantee within big corporations, one notes – through this year’s acquisitions – an increasing interest from companies across vertical industries to position themselves in the AM market. Unlike an AM company that will expand its portfolio of technologies through acquisition, companies in vertical industries invest in technologies that will help further develop their applications. The example of Align Technology and Cubicure perfectly illustrates it and I am keen to see how Align will push this Hot Lithography® process.

| Buyer | Acquired |

| L3Harris | Aerojet Rocketdyne |

| Berlin.Industrial.Group | GEFERTEC |

| Xometry | Tridi |

| ADDiTEC | Xerox |

| Nano Dimension | Additive Flow |

| SLM Solutions | Adira |

| General Motors | TEI |

| RapidFlight | Local Motors’ IP portfolio |

| BigRep | Hage3D |

| Nexa3D | AddiFab |

| Nexa3D | XYZprinting |

| Nexa3D | Essentium |

| Align Technology | Cubicure |

| 3D Systems | Wematter |

| Schaeffler | Desktop Metal |

| GoEngineer | Rapid PSI |

| Cumberland Additive | Stratasys |

| 6K Additive | Global Metal Powders |

| Evonis | Lima Corporate |

| Interfacial Consultants | M. Holland |

| CB-CERATIZIT | CW Toolmaker |

| restor3D | Conformis |

| Hexagon | CADS Additive GmbH |

| Stratasys | Covestro’s AM materials business |

On another note, we haven’t heard of a lot of businesses that shut down their activities – apart from 3D Metalforge and recently Sculpteo which discontinued its online 3D printing marketplace, but restructuring is happening in other ways. Budgets are being reallocated to cope with the slow sales of products. While AMT and 3D Systems are the few companies that publicly announced their restructuring initiative, the growing number of top talents that are “open to work” on LinkedIn indicates that more is happening behind the scenes.

On another note, we haven’t heard of a lot of businesses that shut down their activities – apart from 3D Metalforge and recently Sculpteo which discontinued its online 3D printing marketplace, but restructuring is happening in other ways. Budgets are being reallocated to cope with the slow sales of products. While AMT and 3D Systems are the few companies that publicly announced their restructuring initiative, the growing number of top talents that are “open to work” on LinkedIn indicates that more is happening behind the scenes.

In the midst of this bustle, I am glad to be the bearer of good news: a dozen companies officially debuted on the market this year: ECL, Outokumpu, Evove, JPB Système, SAEKI, 3D BioFibR, flō, Additive Appearance, Pelagus 3D, and ArcelorMittal Powders. Most of them leverage decades of experience and expertise in other core businesses, so I hope they will make it.

Does the devil remain in the details?

At Formnext 2023, I had to look at the smallest details to see exceptional growth and I wanted to apply this approach here. The only thing is that everything was bringing me back to money. From the most established companies, we didn’t see new product launches per se – only improvements of existing processes but from SMEs and companies that do not necessarily rely on investors’ money, we witnessed new technological developments: Thermwood, Solukon, Lithoz and Raise3D are a few that I would like to keep in mind here.

Apart from Lithoz which has benefitted from investors’ money, the growth of the other companies has urged me to attempt to make a realistic assumption for the prospective future of this industry: what if by generating genuine revenue and profits, the industry will further develop, in a prolonged but most certainly sure and continuous way?

But that’s not all. More than ever, investment in thoughtful go-to-market strategies (if you’re a startup – but that’s something we’ll discuss later on) and applications – regardless of your size – always pays off.

Applications, the ultimate promised land

I’ll keep voicing it: no matter how efficient you say your technology is, if you don’t demonstrate it through tangible applications, it will only remain good on paper.

At 3D ADEPT Media, we have understood it since the very beginning, which is why, we cover all vertical industries adopting AM technologies: Aerospace & Space, Defense & Nuclear, Architecture, Fashion, Art, Automotive & railway, Construction, Education, Energy, 3D Foodprinting, High-Tech, Medical & Healthcare, Oil, Gas & Maritime, Sports, R&D, and Sustainability.

As you will see below, the segments where we observed AM activities the most include Medical & Healthcare, closely followed by Aerospace & Space. By AM activities, I mean the development of applications, current collaborations to develop new applications in the upcoming months (or years) as well as specific product launches for each of these markets.

Figure shows the different AM activities per vertical industries covered by 3D ADEPT Media throughout 2023. Graph credit: 3D ADEPT Media.

Figure shows the different AM activities per vertical industries covered by 3D ADEPT Media throughout 2023. Graph credit: 3D ADEPT Media.

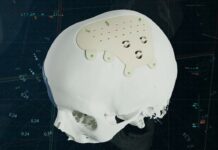

With over 15 applications publicly demonstrated this year, the Medical and Healthcare industries are building a strong case for AM again; the most solid case being 3D printed cranial implants, 3D printed bite splints, 3D printed skin supplements, 3D printed tibia implants, 3D printed medical-grade cushions, 3D printed exoskeletons, 3D printed bandages, ophtalmic, 3D printed medical devices and 3D printed drugs.

I know that most of these applications do not answer the “mass production” concern but let us not try to have it all at the same time. Make baby steps first and if you want to grow quickly, look at applications that have already made a strong case with conventional manufacturing processes and where AM can do better. The production of aligner molds is a great example, and here again, you might learn one or two lessons from Align Technology.

Furthermore, you might be tempted to only look at those industries that invest the most in technology, but a lot is happening in heavy industries and they should be the ones that AM companies should target more next year.

Struggling to survive is the only way to grow

It is precisely because of countless struggles and survival that life becomes stronger and more meaningful. Somehow, this also applies to the AM industry and its people.

From mergers and acquisitions to technology complexities and development, the industry continues to invest resources, time and energy to push for the full integration of AM across vertical industries. If one of the biggest drawbacks is that it remains very expensive, there are always a few ways to alleviate these costs.

This article has first been published in the November/December edition of 3D ADEPT Mag.