Face shields, masks, safety goggles, nasopharyngeal swabs, valves, ventilators…At every corner of the world, 3D Printing has demonstrated its maturity by meeting these vital needs of the medical industry in these times of COVID-19.

If the world can no longer doubt of the capabilities of the technology, the challenging times make it complex to give a clear response on the current state of 3D Printers sales:

“By focusing efforts on producing much-needed medical supplies has meant a move away from the production and sale of printers towards service businesses and service-bureau infrastructure”, said Chris Connery, VP of global analysis at CONTEXT. “Coming on the back of weak shipments in Q4 2019, this refocus – and the supply-and-demand constraints expected in the weeks to come – looks to make 2020 a difficult year for 3D printer shipments.”

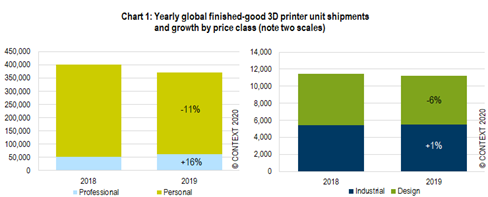

“While COVID-19 had not yet had an impact, global 3D printer shipments were already unseasonably weak in Q4 2019. For many manufacturers – particularly those focused on Industrial* or Design* price-class printers – this slowdown was associated with a weak automotive market, a generally weak manufacturing sector and sluggish Asian and European economies.” First, it should be noted that the research and consultancy firm classifies 3D printers into 4 categories: Personal price-class printers, Professional printers, Design and Industrial 3D printers. Over the quarter, CONTEXT notes that printer shipments saw year-on-year changes of -11% (Personal* price-class printers), +26% (Professional* printers), -22% (Design) and -23% (Industrial); the only increase being in the hot Professional category.

Forecasts for 2020, based on information available as of 23 March, show printer manufacturers are now assessing, on a daily basis, the impacts of a disrupted supply chain and uneven human productivity on both their own ability to produce hardware and the end-markets to which they cater. In recent years, vendors have typically begun with a bullish outlook and slowly adjusted their shipment outlook over the year. Currently, however, vendors are offering only informal/high-level forecasts: most are beginning 2020 with a negative outlook and anticipating they will recover as business begins again once the global pandemic subsides.

While each printer class caters to different users, many of the key end-markets (such as the dental, aerospace, automotive, consumer product, orthopaedics and education markets) are negatively affected by global work closures and slow-downs. On the supply side, key components for printers, as for many other electronic goods, come from China, the region impacted first by the pandemic. As a result of the uncertainty, hardware vendors are now thinking in terms of weeks and quarters rather years, and current aggregate forecasts show the Industrial and Design segments are set to see shipment declines of -4% from 2019 to 2020 even taking into consideration a recovery in the 2nd half of the year.

In the Industrial market – which accounted for 68% of global 3D printer hardware revenues 2019 – shipments in the second half of 2019 were slow, even though this is usually the strongest part of the year, and the outlook for 2020 was, therefore, already challenging. Taking into account both these negative headwinds and the supply-and-demand challenges associated with global reactions to the coronavirus, this segment hopes to see a slide of only -2% in printer shipments in 2020 after its 5-year CAGR of +14% and anticipates a rolling recovery by region, starting with the East.

As the pandemic comes under control and economies return to normal, there is great potential for the 3D printer market since the ability of the technology to assist with the immediate needs of the medical community have showcased its quick-turn capabilities worldwide. Responses to the pandemic are also demonstrating that leveraging 3D printing for local production, instead of relying on complex multinational supply chains, has the potential to help many companies mitigate future risk.

Image via PLM Automation Siemens. Remember, you can post free of charge job opportunities in the AM Industry on 3D ADEPT Media or look for a job via our job board. Make sure to follow us on our social networks and subscribe to our weekly newsletter : Facebook, Twitter, LinkedIn & Instagram ! If you want to be featured in the next issue of our digital magazine or if you hear a story that needs to be heard, make sure to send it to contact@3dadept.com