3D printing may have started with desktop 3D printers but the current demand for more industrial applications is raising a lot of debates on the future growth of this specific segment. Interestingly, despite their DIY roots, the desktop 3D printing market that has almost always been associated with FFF 3D printing has expanded to encompass resin 3D printers which have found their niche in industries like jewelry. But is it enough to drive the growth of this segment? As the industry strives for the industrialization of AM, it’s fair to reassess the importance and current place of desktop 3D printing in this journey.

First and foremost, desktop 3D printers are machines that are sold for less than $ 5,000 and that can easily stand on a desktop office. Obviously, this price varies from one OEM to another as the market is also filled with desktop 3D printers that cost more than $ 5,000. It all comes down to the capabilities of each 3D printer.

The problem with desktop 3D printing is that not only was it behind the media hype of the 2010s – when the technology was trying to carve out a legitimate place in the market, but this hype generated unrealistic expectations regarding its true potential at the time. As time went by, most of the analyses made on 3D printing were made with those expectations as a basis.

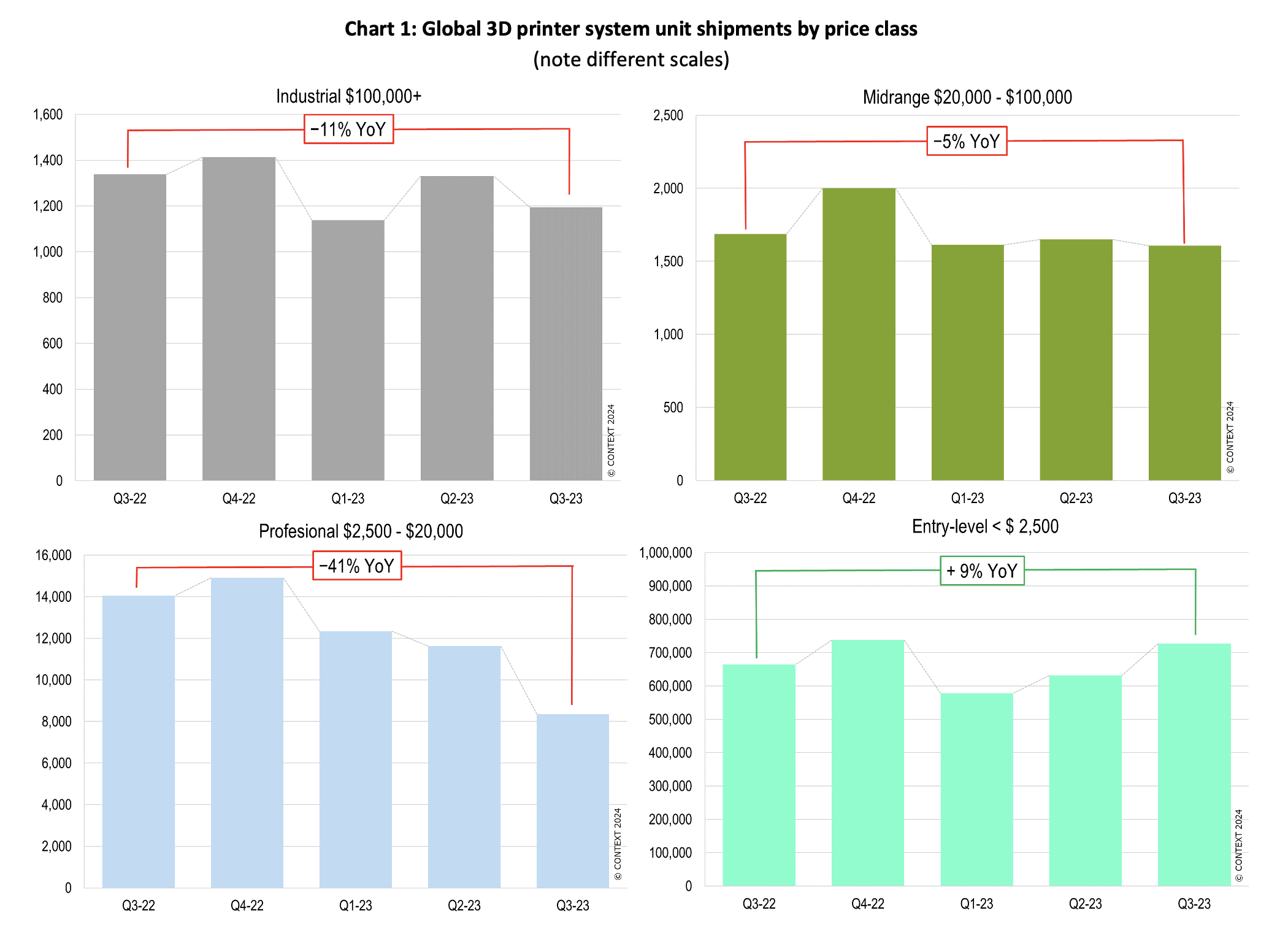

Eventually, with the increasing focus on industrial 3D printing, desktop 3D printing has been unconsciously relegated to the status of “a consumer or educational technology.” Yet, today, according to CONTEXT’s latest report, “entry-level printers remain the hottest segment” of the market.

CONTEXT is a market intelligence and analysis firm that tracks global 3D Printer shipments quarterly. The company has seen the ENTRY-LEVEL category (consisting of printers selling for $ 2,500 and below) see the most consistent growth with shipments in Q3-23 up +9% from the prior year.

Before Chris Connery, VP of Global Analysis and Research, explains this context, I would like to emphasize that being labeled “a consumer or educational technology” is not pejorative – especially when one realizes that the ENTRY-LEVEL 3D printer segment represents the 2nd largest market with 28% of the global system revenues coming from the sale of products in this price-call over the trailing-twelve-months.

“While most of the industry headlines rightly surround happenings in the industrial price class (which accounted for 53% of the global system revenues in the TTM), the low-end 3D Printers are not just toys for consumers with this segment representing an important gateway for many to learn and understand various 3D Printing concepts,” Connery outlines.

Speaking of the reasons why these entry-level printers remain the hottest segment, he continues:

“On a trailing twelve-month’s basis (Q4-22 to Q3-23) compared to a year-ago (Q4-21 to Q3-22) shipment growth was even stronger with +12% more printers shipped globally. While this side of the market continues to see gains by market share, leaders like Creality, Anycubic and Elegoo (with Creality holding a particularly strong market-share lead), upstarts like Bambu Lab have really taken the market by storm and helped to grow this market. While in the past, products at the low end were assumed to be just for consumers, research shows that companies like Bambu Lab have seen strong growth in non-consumer markets. For this reason, CONTEXT has recently moved away from classifying such products as “PERSONAL” 3D Printers (or “Desktop” or “Consumer”) printers to rename this low-end as “ENTRY-LEVEL” to help highlight the increasing sales of these products in more professional markets. To better highlight this trend, shipments in the price-class CONTEXT calls PROFESSIONAL (which consist of printers in the $ 2,500 to $ 20,000 price-range) have seen a -27% drop on a TTM (trailing-twelve-months) basis showing the cannibalization of PROFESSIONAL products by lower-priced ENTRY-LEVEL printers. Key to this growth in the ENTRY-LEVEL category (and decline in the PROFESSIONAL category) has been global inflation which has pushed price points up, causing buyers to seek lower-price alternatives. The introduction of more feature-rich “professional” type products at lower prices in this ENTRY-LEVEL category has seemingly been well received and allowed buyers to comfortably shift demand from higher-priced PROFESSIONAL products to lower-priced ENTRY-LEVEL products without feeling that they have sacrificed functionality or quality.”

I hear what Connery is explaining about those entry-level 3D printers and I can’t help but think that somehow, these brands that have the strongest market share (Creality, Anycubic and Elegoo) have been victims of their reputation – that is “designed for consumers and makers”. I still remember how a Creality employee told me two years ago that he sold about 200 Creality 3D printers to a big aerospace company but nobody would ever know about that. The fact is, it’s fancier to say that a multinational conglomerate buys 3 industrial 3D printers rather than 200 Creality desktop machines.

To avoid such generalization and labels related to desktop 3D printing, Connery seems to recommend one should rather categorize those 3D printers by price-classes:

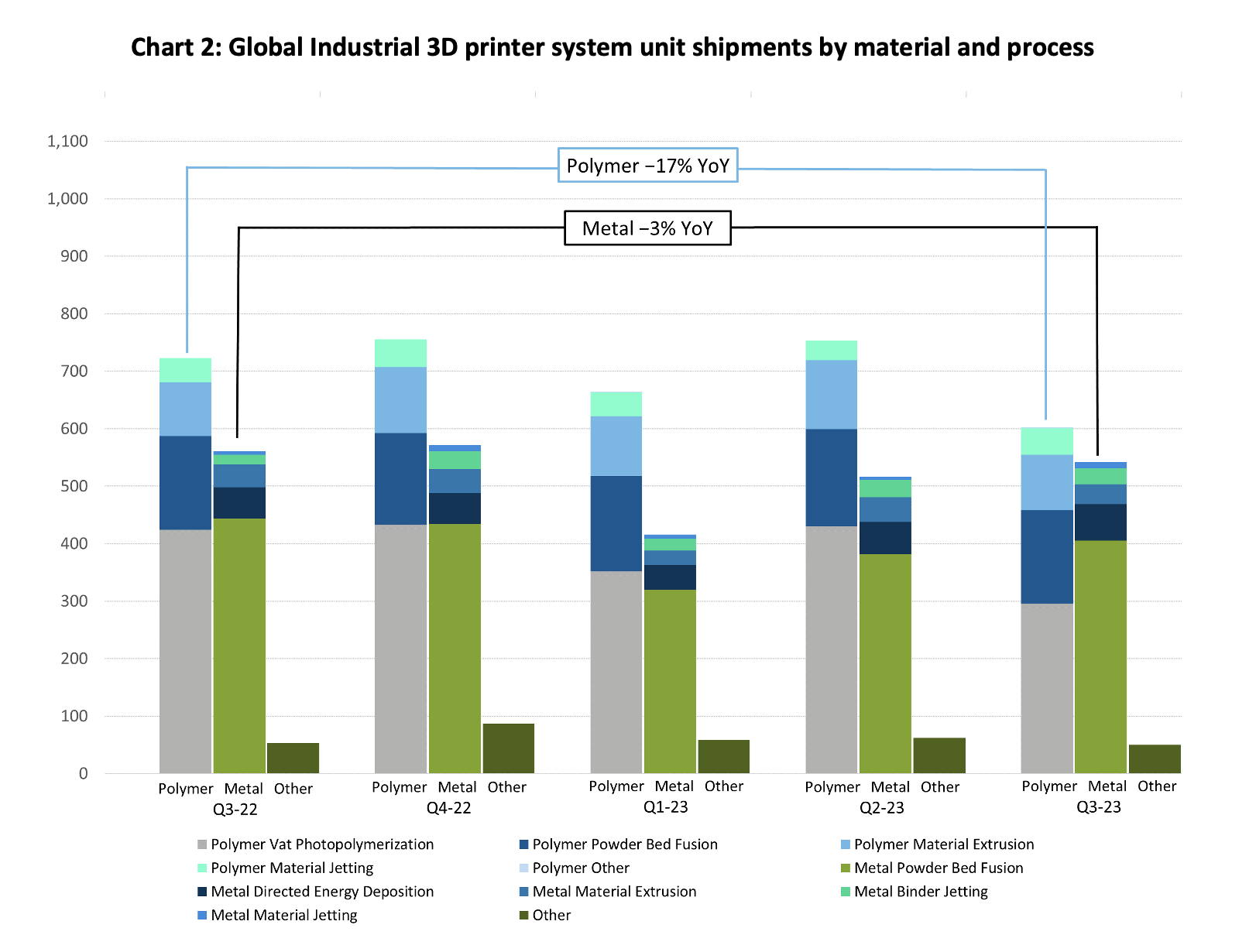

“Often times people reference the “consumer goods” segment as a key end-market for 3D Printing/Additive Manufacturing but indeed it gets a bit confusing when painting the “3D Printing” market as one, cohesive market. For example, there are printers which costs millions of dollars and sit on factory floors, down to desktop variety products which cost a few-hundred dollars and are often used by general consumers typically in the home. To help compartmentalize various solutions and end-markets, CONTEXT compartmentalizes printer hardware by price-classes which it calls ENTRY-LEVEL (for printers under $ 2,500), PROFESSIONAL (those ranging in price from $ 2,500 to $ 20,000), MIDRANGE ($ 20K – $ 100K) and INDUSTRIAL ($ 100K+). Beyond this high-level price-class distinction, printers can be further segmented by printer type (such as polymer resin-based VAT Photopolymerization printers or polymer Material Extrusion printers or even laser-based metal Powder Bed Fusion printers in the INDUSTRIAL price-class), different materials which various printers can handle (such as Polymers, Metals, Ceramics, Composites, Bio, etc.), end-markets in which these printers are used (such as Aerospace, Medical, Hobby, etc) and even the principle use of these printers (used for prototyping, for single end-part production, for mass-customization, for volume production, etc.) Often when people reference the “consumer goods segment” of the 3D Printing market, they mean the use of industrial machines in the mass production of consumer goods. Today already, industrial 3D printers are used for manufacturing of certain consumer goods like the mid-soles of running shoes (a consumer good). Others are experimenting with using 3D Printers to mass-produce jewelry or even parts for mobile phones and smartwatches. Another way that people sometimes reference “consumer goods” when talking about 3D Printing, however, is the in-home use of ENTRY-LEVEL printers for general consumers to make products for themselves. For its tracking, CONTEXT classifies the end-markets for ENTRY-LEVEL 3D printer usage either by those unique to the consumer market including: Hobby/DIY, Gadget, Household and Scale Model or by their principal use including: DIY, Toys&Games, Hobby/Household and Fan Art. The growing trend being seen however is the use of these products for more industrial and professional end-markets including: Automotive, Medical & Healthcare, Dental, Aerospace & Aviation, Jewelry, Education, R&D, Art & Architecture, Energy, Oil & Gas and Movie Props. Some areas for the biggest growth in ENTRY-LEVEL printer shipments have been in Dental (from resin-based printers) and in Automotive, Medical & Healthcare, Aerospace & Aviation and Jewelry markets all of which considered professional (versus consumer).”

So, the communication purpose and the labels left aside, what can truly justify an investment in several desktop 3D printers for one’s business rather than one industrial 3D printing machine?

We need to recognize something: current desktop 3D printing solutions have overcome the limitations of earlier machines, and now provide strong reliability and versatility. The hardware, software, and materials have been enhanced to offer a hassle-free user experience.

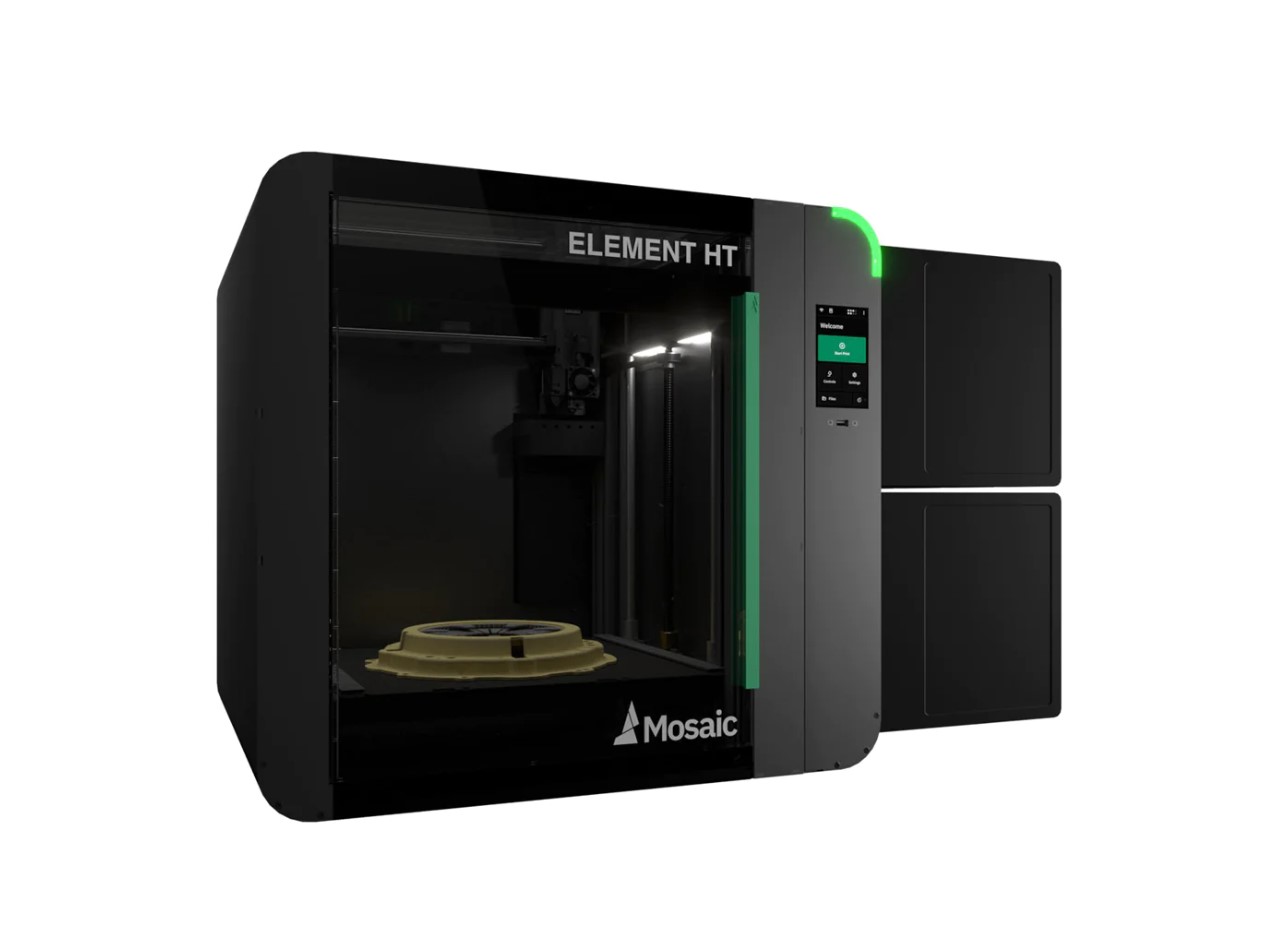

That being said, for Mitch Debora, CEO of Mosaic Manufacturing, a Canada-based 3D printer manufacturer, “the reason businesses are choosing to invest in several professional level printers over a single industrial system is all about scale and cost control. The demand for additive manufacturing is increasing significantly within businesses in product development and manufacturing. They understand that multiple printers running in parallel will significantly outperform a single industrial printer in both throughput and part cost. There is a case to be made for $ 100k+ industrial printers in niche applications where a specific feature set is required but for the most part, investing in 5 x $ 10k capable professional printing systems will put a business in a much better position. We see this all the time at Mosaic where businesses will sell off their legacy industrial printers and replace them with several of our ELEMENT HT multi-material and high temperature printers.”

Taking the example of its Element and Array 3D printers, he explains the reasons that may lead one company to invest in the Element solution rather than the Array: “At Mosaic, we offer a desktop printer called Element as well as an automated production system run by robotics called Array. Typically a business that has demand for 5+ printers will purchase an Array since the robotics free’s up their employees time to work on value generating work rather than spending time operating the printers 24/7. Businesses see a very quick ROI on Array by freeing up the staff’s time thanks to the robotics in Array. Businesses who invest in Element typically do so either because they don’t have the capacity requirements that Array offers or because they are looking to validate a business case before investing in a fleet of Arrays. It is common for us to see a customer buy an Element and then upgrade to an Array or to buy an Array and then to upgrade to 5 Arrays – the modularity of these building blocks makes it effortless for companies to incrementally grow capacity with their business.”

Debora’s explanation highlights the current possibilities of desktop 3D printing – possibilities that show how it can be a great addition to a workshop because it seems to make the capabilities of high engineering possible in a safe, easy-to-use bundle that can enable savings while delivering ROI.

How might the desktop 3D printing market evolve this year?

I am more optimistic about desktop 3D printing and how it can be deployed across industries to achieve various manufacturing purposes. Bear with me, I am not saying desktop 3D printers could match the performance of industrial machines. Industrial 3D printers will always lead the way in some industrial settings, but there is a legitimate place today for desktop 3D printing in such settings as well.

“I don’t see it as a rise and fall of desktop printers so much as I see it as the ride of desktop printers alongside the rise of industrial printing systems,” Mosaic Mfg CEO reacts when asked if it was a “rise and fall” situation.

“At times it can seem like the desktop segment is falling but I think this is an illusion and is more a symptom of industrial systems outpacing desktop systems at that moment. Both segments are growing at a healthy pace year over year and are complementary. For example, it is common that industrial applications are inspired by teams who had access to desktop printers (at home or at work) and connected the dots between challenges in their business and the capabilities of additive manufacturing. The more capable and accessible that hobby grade desktop systems at the low end of the market become, the larger the funnel of technical people there will be who will inspire the next 100 killer applications for additive manufacturing. This year I expect desktop printers to become more capable in material properties, throughput, and user experience,” he concludes.

This dossier has first been published in the January/February edition of 3D ADEPT Mag. Featured image: Desktop 3D printer Element HT. Credit: Mosaic Mfg

Remember, you can post job opportunities in the AM Industry on 3D ADEPT Media free of charge or look for a job via our job board. Make sure to follow us on our social networks and subscribe to our weekly newsletter : Facebook, Twitter, LinkedIn & Instagram! If you want to be featured in the next issue of our digital magazine or if you hear a story that needs to be heard, make sure to send it to contact@3dadept.com