Whenever I sit down to write our “year in review” articles, I can’t help but notice that coincidentally, these articles are prepared right after Formnext – the world’s largest Additive Manufacturing event of the industry. It may probably look weird to you but since I usually leave that event pumped with positive energy and inspiration, it is tempting to limit what happened in eleven months to just one week. And just before writing a romance novel about our industry, the analyst in me tells the optimist part of myself: think twice – this industry is more than glitz and glamour.

And that’s what I did. I thought twice – and more. And the more I think…

…the more I see “financial stress”

Is that different from what I pointed out last year? Not really, you might tell me. I don’t want to sound contradictory but let’s take the example of Formnext 2024. Despite the slight increase in figures compared to Formnext 2023, there were a lot of empty spaces across the halls and noticeable absentees.

This can be explained by the fact that exhibitors simply took less space this year. A company like Oerlikon AM told me that since they restructured their business to focus more on the USA market, it didn’t make any sense to them to have a huge booth. Fair enough.

Others had a spot in their parent company’s or partner’s booth. That’s the case of Desktop Metal (DM) and its hard-to-notice spot in Nano Dimension’s booth.

Others simply didn’t show up – due to “financial constraints”. In the list of absentees, we can’t help but mention OEM Nexa3D. The OEM appeared last year as one of the top companies advocating for consolidation with three new companies under its umbrella: AddiFab, XYZprinting and Essentium. Its acquisition of filament maker 3D-Fuel didn’t go exactly as planned this year and the startup returned to independence in August 2024. Following insolvency rumors after its absence at Formnext 2024, Nexa3D explained they had decided to focus inward – and prepare for the move to new headquarters. I guess in this case, the best I can say is that the future will tell us.

Beyond that Formnext week, the financial stress can be seen in the number of companies that shut down their operations this year. Coincidentally, that number almost equals the number of newcomers in the industry.

Apart from Apiumtec, Forward AM, Zeda Technologies Inc.’s Aerospace and Defense company and Velo3D that are going through some financial troubles, this year, we bid goodbye to three material producers – KIMYA, Braskem, Uniformity Labs – one reseller – 3D FilaPrint – one software company – Sigma Additive Solutions, and a machine manufacturer Sintratec.

We welcomed nPower Technologies, VRC Metal Systems, Verne Additive Manufacturing Labs, Ecogensus, Fluent Metal, and Xenia.

And acquisitions. It’s now a fact. Acquisitions are part of our AM journey. However, the reason behind each acquisition varies from one company to another. If last year, we shed light on the willingness of buyers to position themselves in this market, this year, these consolidations highlight the need to remain financially stable.

Unlike last year where we covered over 24 acquisitions, this year saw the reporting of about 15 acquisitions.

| Buyer | Acquired | Exit stake |

| Siemens | Altair | Sandvik exits stake in BEAMIT |

| Nano Dimension | Markforged | |

| Anzu Partners | Voxeljet AG | 3DFuel returns to independence |

| GoEngineer | Inceptra | |

| ADDMAN Group | Keselowski Advanced Manufacturing (KAM) | |

| Materialise | FEops | |

| Wall Colmonoy | Indurate Alloys Ltd | |

| Vision Miner | Addwise Manufacturiung | |

| Sodick | Prima Additive | |

| Stratasys | Arevo | |

| Kymera International | Royal Metal Powders | |

| Zeda | The Orthopaedic Implant Company (OIC) | |

| Prototal | CA Models | |

| CurifyLabs | Mehta Heino Industries Oy | |

| LAB14 Group | Nanoscribe |

I am pretty sure we will continue to witness a wave of consolidation moving forward but I will keep in mind that to date, those who bootstrap their business seem to be in a more steady state than those who take VC money.

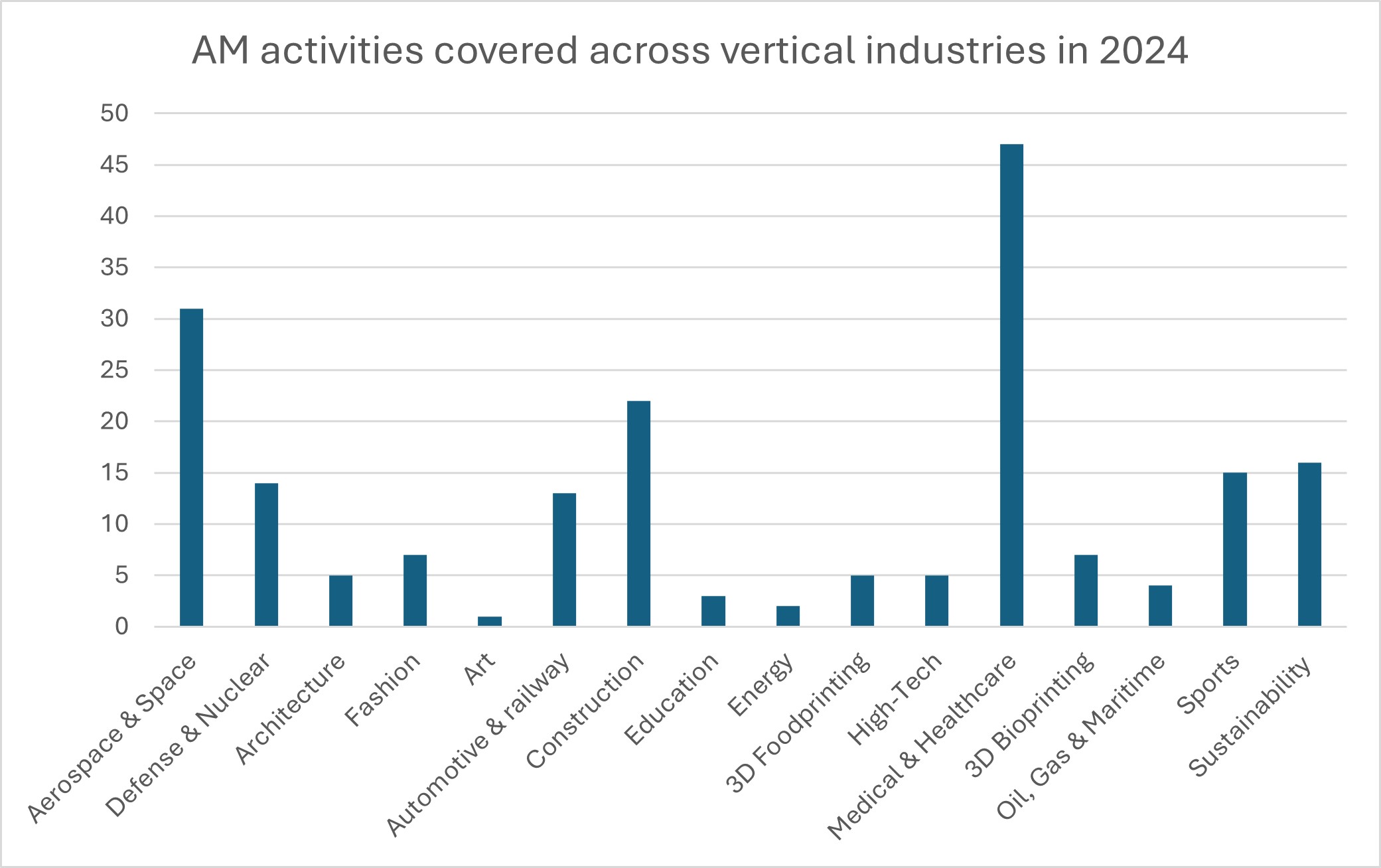

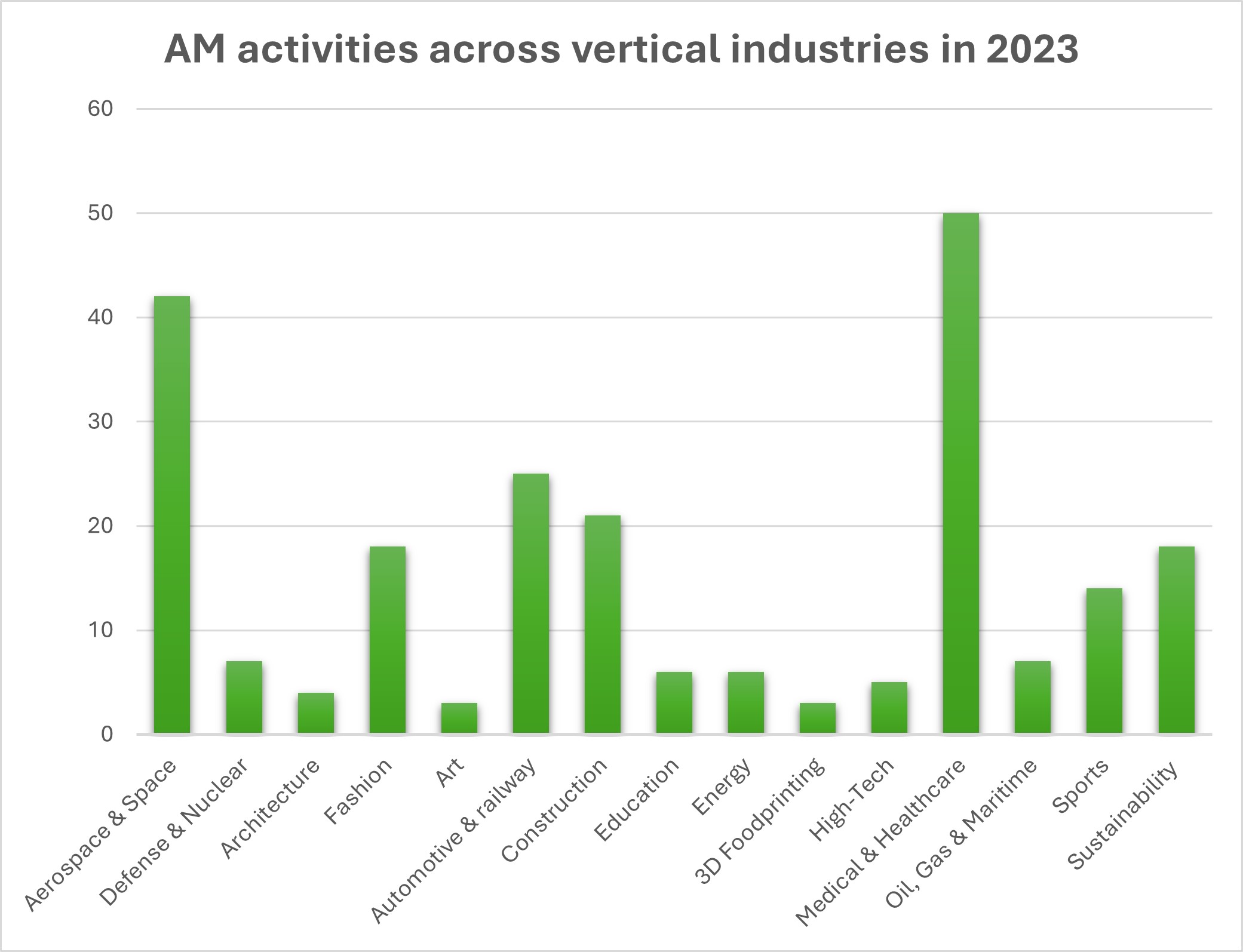

…the more I realize that “applications become a unique selling point”

Throughout the year, most of my interactions with 3D printer manufacturers were the same: they didn’t necessarily highlight the capabilities of their 3D printers but rather the applications a specific 3D printer could deliver.

It comes down to what we once told you: applications make the industry evolve in a virtuous circle: “the more designers design products, the more applications we will have. The more applications there are, the more materials will be developed, and the more printers will evolve or be introduced to the market.” And in the end, a client will find themselves buying a complete package of solutions from an OEM.

It’s too soon to call it a trend but that’s probably something we should watch out for next year.

…the more I see “defense” as the vertical that will propel AM technologies the most

“In a world of renewed conflicts and geopolitical rivalries, defense requires visionary leadership—including in advanced technologies,” Josep Borrell, Former High Representative of the European Union for Foreign Affairs and Security Policy / Vice-President of the European Commission said.

While this vertical industry raises a lot of concerns among AM enthusiasts and users across other industries, we can’t ignore the fact that defense organizations across the world are investing heavily in key technologies.

In the AM industry, we see a number of events that provide a space for the use of AM in the military and defense sectors. In addition to the Military Additive Manufacturing Summit which is the first event to highlight the use of the technology across these sectors, other events increasingly spotlight AM technologies. They include AM industry events like Formnext as well.

Russia’s attack on Ukraine may be one reason explaining this surge in new technologies, and it’s crucial to acknowledge that this trend is likely to continue in 2025.

In the United States alone, the Biden administration has requested a budget of US$849.8 billion for the Department of Defense (DoD) for fiscal 2025. The budget priorities may act as a catalyst for further industry spending in unmanned systems and the space economy. Specifically, the commercial sector is likely to continue advancing toward advanced air mobility (AAM) solutions. Finally, it is likely that, in 2025, aerospace and defense companies will prioritize resiliency and visibility in their supply chains to ensure the future of their technologies, a report from Deloitte reads. Interestingly, these are all the areas where AM has proven to be effective.

On another note, while the EU is home to 5 of the 15 largest global defense contractors by market capitalization, the European defense industry landscape remains populated mainly by national players operating in relatively small domestic markets. While it is not clear yet how much budget has been allocated for fiscal year 2025, we do know that the EU has put in place the European Defence Fund (EDF). With a budget of €8 billion over the 7–year period of the Multiannual Financial Framework, several European organizations and companies will be brought together through common R&D projects.

…the more I see the rise of Asian AM companies

We do not have to emphasize the rise of Asian AM companies in this article to avoid unnecessary repetition with our Formnext coverage.

…the more there is uncertainty about what’s next

There was a time when most CEOs and investors kept saying that “There’s never been a better time to be in Additive Manufacturing.” The current market certainly makes it difficult to reiterate these words with confidence but when I see that vertically integrated AM businesses like Domin or Conflux Technology continue to strengthen their positioning, I find some beauty in that uncertainty.

This dossier has first been published in the November/December edition of 3D ADEPT Mag.