During a recent networking event, a group of investors argued that, outside the AM sector, OEMs that sell equipment and offer on-demand or contract manufacturing services tend to be more profitable — or at least more resilient — with margins up to four times higher than equipment sales alone.

The implication? That AM OEMs are now adopting the same dual approach, a move some see as a natural evolution. But as I listened, one question lingered: Could this shift threaten the very existence of AM service providers? With no service providers at the table to weigh in, I decided to explore the issue in a business feature for 3D ADEPT Media.

The more I reflected on that idea, the more I realized that the big names in the AM OEM landscape are replicating a proven strategy: sell the machine, then provide software, materials, design support, and even make the parts, capturing multiple stages of the value chain. But this recipe for success doesn’t work for everyone. Sintratec and BCN3D, for instance, ended up offering on-demand manufacturing services in their areas of expertise (SLS and FFF, respectively), yet still filed for bankruptcy. (*Disclaimer: Since the drafting of this article, BCN3D found a way to renew from its ashes).

If we focus only on the winners of this race, we might be tempted to say that by offering both equipment and services, OEMs can lock customers into their ecosystems, make themselves indispensable, or even shape market standards and influence pricing.

Marleen Vogelaar, CEO, Shapeways, slightly disagrees with me as she believes OEMs and AM service providers have distinctive roles:

“3D printer manufacturers are specialised in developing, manufacturing and selling 3D printers. AM service providers like Shapeways are manufacturing problem solvers with a deep understanding of the whole 3D printing market and how the technologies can best be deployed. Or not deployed!

While it’s understandable that there is some overlap in capabilities between the two, I see distinct roles for each that require their focus. We have great relationships with many of the 3D printer manufacturers whose machines we run all day, producing parts for our clients. Our ability to be technology agnostic is incredibly important however. A 3D printer manufacturer will of course come to the conclusion that one of their own technologies is the best suited for the job; our customers appreciate our ability to understand their needs deeply and offer the best solution, or combination of solutions, from the market.

Beyond that, to help our clients with their challenges requires both focus and breadth of knowledge. While 3D printing underpins Shapeways, we are often helping clients to build resilience into their supply chains, or transform their operations to digital inventories. I don’t think it’s possible to provide that level of service as an ‘add on’ to another set of core operations.”

Shapeways has been making headlines repeatedly over the past year. Once a pioneer among 3D printing service providers, the company hit rough waters, filing for bankruptcy in mid-2024. Its European operations were later acquired by Manuevo BV—a venture led by Shapeways’ original founders, aiming to revive the brand. By December, the company officially emerged from bankruptcy, opening a new chapter and a fresh opportunity to rebuild.

“There are benefits for all customers that might draw them to an independent service provider like Shapeways. For startups, the accessibility and experience are hugely beneficial; while they may be facing a challenge for the first time, it’s likely we have solved it, or a closely related challenge, before.

Because problem solving is our core business we’re always looking for the right solution, rather than a solution from a limited portfolio. Solving the problem is also our endgame and sole focus, not a step in a process to sell a 3D printer.

Large enterprises will be mindful of ensuring multiple suppliers and having some resiliency in their supply chains. Relying on a single OEM is therefore more risky than partnering with an experienced independent who can help adapt to changing market conditions. We will offer the technology that meets our clients’ needs regardless of OEM, and if one system becomes unavailable, we can pivot to an alternative supplier without affecting our end customer.

Mixing in-house capabilities with a global network of partners delivers maximum flexibility in reacting to customers’ changing needs — something that is really important in fast-moving markets,” Vogelaar continues.

Vogelaar’s explanation somehow made me think of something my grandma used to tell me: “There is a shoe for every client”. Furthermore, she somehow emphasizes a key benefit of AM service bureaus: adaptability, an argument that Alexandre d’Orsetti, CEO, Sculpteo, illustrates perfectly:

“The type of machines we use at Sculpteo are industrial 3D printers. As far as I know, the manufacturers of these machines do not typically offer manufacturing services through online platforms. While this might occasionally happen with a few manufacturers, I don’t see it as a threat.

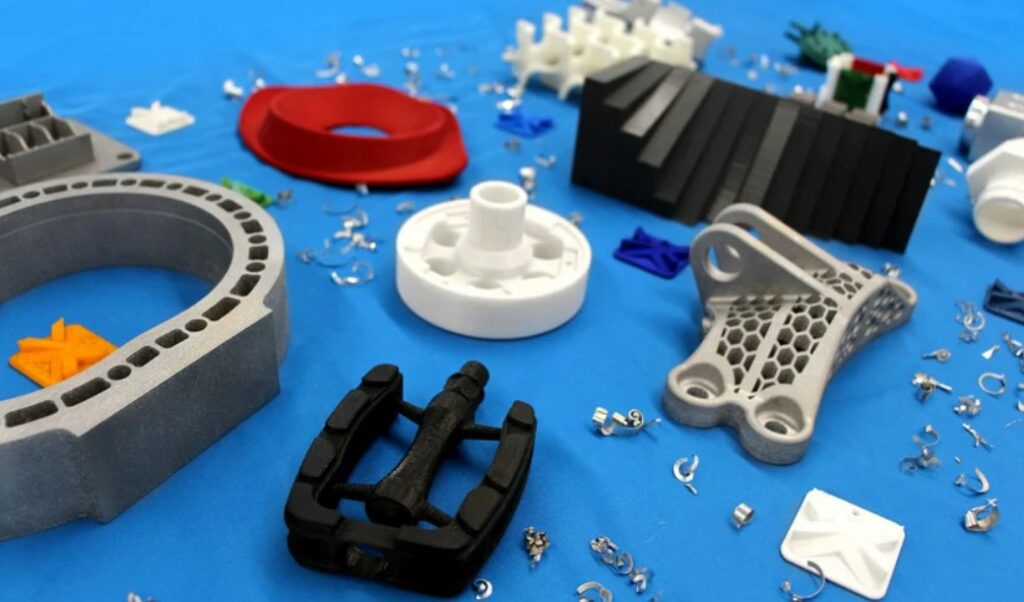

For most customers, we serve as a one-stop shop, offering a broad range of technologies and materials – something that would be difficult for a single machine manufacturer to match, given the limited number of technologies they can support. We maintain strong partnerships with several machine manufacturers, whom we view as collaborators, but we are not tied to any single one. Our approach is to remain machine – and technology – agnostic.”

Sculpteo, once a vocal player in democratizing 3D printing – at the time of Clement Moreau (Ex-CEO and ex-cofounder) -, became more reserved after its acquisition by BASF in 2019. Nevertheless, the company continues its industrial 3D printing services, serving over 95% professional clients, backed by a large fleet including HP MJF, SLS, SLA printers across Europe and North America.

For d’Orsetti, each customer has their own reasons for choosing independent service bureaus. “What makes a large independent service bureau particularly attractive is our ability to offer the best technology and materials based on the customer’s specific needs. Our independence gives us access to a wide range of products, which adds to our credibility. Naturally, large enterprises also tend to prefer independent providers-especially those with the capacity to handle high-volume production,” he explains.

Adaptability: Yes, but not at the expense of specialization

In an ecosystem where AM OEMs increasingly offer on-demand production, software, and consulting, service bureaus that remain generalists risk irrelevance.

Looking at the likes of ADDMAN or Sintavia specializing in aerospace, defense, and energy, Zeda in medical and orthopaedic implants, or even Materials Solutions in turbomachinery and energy parts, I understand Sculpteo’s CEO point of view when he says, their vision is “to specialize in specific verticals, developing in-depth knowledge and complementary services. The goal is not merely to produce a plastic or metal part, but to deliver a product that is ready, or nearly ready, for end use, with a clear understanding of its function and application. This approach is exemplified by our work in sectors like medical and luxury goods, which demand highly specific and differentiated solutions.”

Adaptability: Yes, by combining multiple manufacturing capabilities

Beyond flexibility and cross-industry applications, service platforms help customers redefine procurement of parts and the way they want to produce. Therefore, they build resilience by providing access to comprehensive manufacturing ecosystems beyond AM and the possibility of producing wherever you want in the world. That’s the reason why, platforms like Xometry do not want to see a 3D printer manufacturer turning into a service provider as a threat, but rather as an opportunity. Xometry’s platform goes far beyond additive manufacturing—and provides CNC machining, injection molding, and many other technologies, with hundreds of combinations of materials, finishes, and other specs.

“If a 3D printer manufacturer enters the market as a service provider, has available capacity, and can deliver high-quality parts, we’re more than happy to welcome them as a manufacturing partner on our platform. Often, we’re looking at fundamentally different business models and customer segments. So when printer manufacturers move into production, we see them as potential collaborators—with strong potential for synergy. [In the same vein,] We’ve observed that highly specialized customers—typically those with deep AM experience or very niche applications—tend to prefer independent providers who focus on specific materials or capabilities. In contrast, most enterprise customers prioritize breadth, speed, and reliability, and turn to platforms like Xometry, where they can access multiple manufacturing processes and suppliers through a single quote and a unified interface,” Dmitry Kafidov, Managing Director at Xometry Europe.

As an organization that has always leaned more into the 3D printing niche, Shapeways’ CEO underscores that AM is not a standalone technology, and that’s something the organization understands and embraces: “We actively adopt multiple manufacturing technologies which allows us to tackle the greatest number of challenges. While the OEM market in AM specifically might be consolidating, the technologies still have a role to play in solving manufacturing problems. In future, I expect other service providers to double down on their expertise while bringing in complementary and even competing technologies in-house. It’s easy to be ‘head down’ in business, but the management team at Shapeways forces the whole organisation to look up and see how the industries we serve and the tools we need to serve them are changing. As long as AM remains the best tool for a given job, we will continue to champion it (and I expect that to be the case for a long time to come!), but AM is only ever part of the toolset,” Vogelaar adds.

Success factors and future outlooks

The lines above offer a glimpse into how service platforms are building resilience in an increasingly consolidated AM industry. More importantly, they reveal that each company is shaping its own definition of success.

That said, they all seem to agree on the fundamentals:

– Delivering top-quality products

– At competitive prices

– With fast turnaround times

– And with a strong customer focus or deep understanding of customer applications

For Xometry, scalability and enabling technologies, like instant quoting and automated order tracking—are additional key performance metrics. Sculpteo, on the other hand, prides itself on owning its production equipment and managing nearly all manufacturing in-house. This model pushes the company to excel in both software operations and physical (brick-and-mortar) production.

While she emphasizes the importance of trust in serving customers, Shapeways’ Vogelaar made me reflect on something broader. If there’s one thing we can take from their journey, it’s this: “where there’s a will, there’s a way. When there’s a real desire to solve problems and serve the customer, solutions tend to follow.”

Moving forward, service platforms will likely combine on-demand printing, consulting, distributed manufacturing, and platform-as-a-service models, if they aren’t already, in order to stay relevant in an increasingly complex industry.

This dossier has first been shared in the 2025 May/June edition of 3D ADEPT Mag. Discover the entire issue here. Featured image: Shapeways