Additive Manufacturing company Markforged plans to go public in a merger with one, a blank-check company founded by Kevin Hartz, cofounder and chairman of Eventbrite. After the merger with this publicly traded company, the 3D printer manufacturer is expected to have an equity value of $2.1 billion.

In eight years of activity, Markforged has delivered value to customers across key verticals. Its metal 3D printing and proprietary continuous Carbon Fiber Reinforced (CFR) composites solutions are used across industrial automation, aerospace, military and defense, space exploration, healthcare and medical and automotive industries.

With over 170 issued and pending patents, Markforged has successfully installed its products in 10,000 facilities across 70 countries. Its AM solutions have achieved the production of 10 million parts across the entire product development lifecycle, from R&D to aftermarket repair.

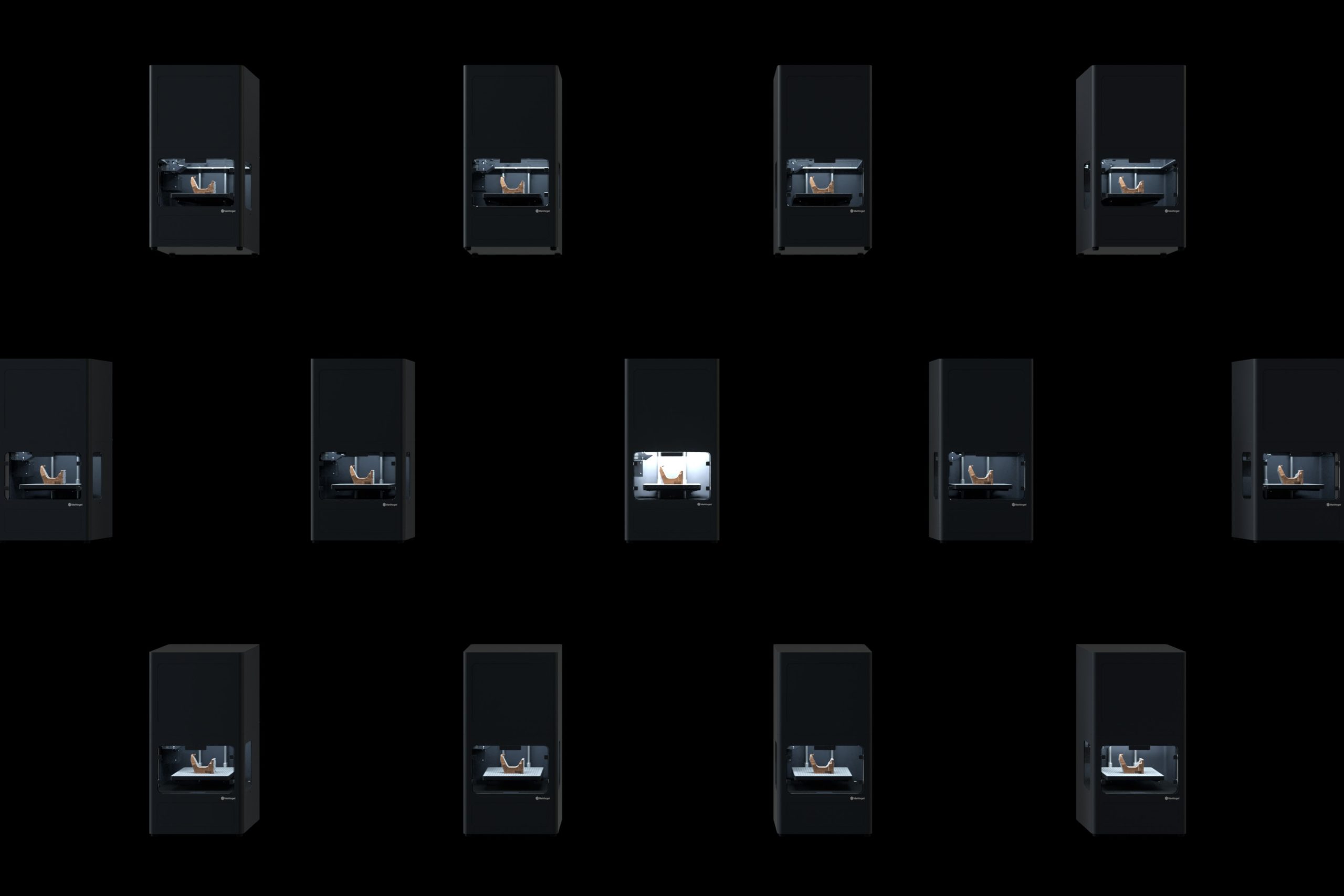

Its latest solution to date, the Digital Forge is a cloud-based platform for 3D printing that connects the manufatcurer’s products together in one offering in order to make production-grade parts on demand.

“Our mission and vision are to reinvent manufacturing by bringing the power and agility of connected software to the world of industrial manufacturing. Today is a pivotal milestone as we progress towards making that vision a reality,” said Shai Terem, President and CEO of Markforged. “We’ve been at the forefront of the additive manufacturing industry, and this transaction will enable us to build on our incredible momentum and provide capital and flexibility to grow our brand, accelerate product innovation, and drive expanded adoption among customers across key verticals. We’re focused on making manufacturing even better by capitalizing on the huge opportunity ahead, and we are making this important leap through our new long-term partnership with Kevin Hartz and the entire team at one, a group of seasoned founders and operators with unparalleled experience. Their expertise and guidance will be invaluable as we continue to reinvent manufacturing today, so our customers can build anything they imagine tomorrow.”

How will the transaction work?

In a communication, Markforged explains that the combined company will have an estimated post-transaction equity value of approximately $2.1 billion at closing. The transaction will provide $425 million in gross proceeds to the Company, assuming no redemptions by one shareholders, including a $210 million PIPE at $10.00 per share from investors including Baron Capital Group, funds and accounts managed by BlackRock, Miller Value Partners, Wasatch Global Investors and Wellington Management, as well as commitments from M12 – Microsoft’s Venture Fund and Porsche Automobil Holding SE, existing Markforged shareholders. Net transaction proceeds will support Markforged’s continued growth across key verticals and strengthen its competitive advantage with new products, proprietary materials and expanded customer use cases.

Current Markforged shareholders are expected to hold approximately 78% of the issued and outstanding shares of common stock immediately following the closing. The transaction, which has been unanimously approved by the boards of directors of both Markforged and one, is expected to close in the summer of 2021, subject to the approval of both one and Markforged stockholders and regulatory approvals, as well as and other customary closing conditions.

Kevin Hartz, Founder and CEO of one, commented, “Markforged has already reinvented the additive manufacturing industry and is well-positioned for robust growth benefiting from the velocity of digitization. When launching one, our priority was to partner with a company with exceptional founders, visionaries and operators taking a differentiated approach in large and growing markets – Markforged ticked all of those boxes and more. We’re thrilled to be working closely with the entire Markforged team, comprised of highly engaged founders, visionary leaders and world-class engineers, uniquely positioned to lead a revolution in modern manufacturing.”

Following the completion of the transaction, Shai Terem will continue to lead Markforged as President and CEO. Kevin Hartz will join the Company’s board.

This announcement from Markforged follows an earlier move by Desktop Metal, which also went public in a SPAC deal last year.

Remember, you can post job opportunities in the AM Industry on 3D ADEPT Media free of charge or look for a job via our job board. Make sure to follow us on our social networks and subscribe to our weekly newsletter : Facebook, Twitter, LinkedIn & Instagram ! If you want to be featured in the next issue of our digital magazine or if you hear a story that needs to be heard, make sure to send it to contact@3dadept.com