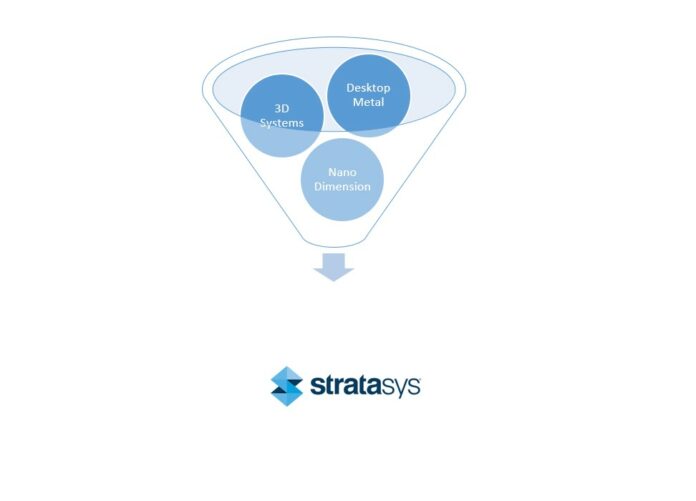

A few weeks ago, 3D Systems made a bid to acquire Stratasys, and the latter recently announced that its Board of Directors, after careful review and consultation with its independent financial and legal advisors, unanimously determined that the May 30, 2023 ‘unsolicited non-binding indicative proposal’ from 3D Systems Corporation to acquire Stratasys does not constitute a “Superior Proposal”. Therefore, it does not provide a basis upon which to enter discussions with the company, pursuant to the terms of the merger agreement with Desktop Metal.

If at this point, Stratasys strongly believes that Desktop Metal has the best and most advanced technology for mass production hence their interest in a merger agreement, does not seem to be in a “complete rejection of negotiations”, as its response to Nano Dimension implied. As a reminder, the company described Nano Dimension’s offer as “unsolicited, inadequate, and coercive”

In the meantime, 3D Systems has issued an update to its shareholders regarding its proposal. President and CEO Dr. Jeffrey Graves stated, “We are disappointed that the Stratasys Board has taken this step, particularly in light of the tremendous value of our proposed transaction, the broader skepticism of the merits of a Stratasys and Desktop Metal combination expressed by the market, and the overwhelmingly positive reaction to our proposal. We remain undeterred in our belief that a transaction between 3D Systems and Stratasys on the terms proposed constitutes a ‘Superior Proposal.’”

“We continue to believe that a combination between 3D Systems and Stratasys offers shareholders the best blend of immediate value, potential for long-term growth, and certainty to close. We believe the overlap between 3D Systems’ and Stratasys’ technologies has been mischaracterized by Stratasys, as well as the potential from the highly experimental Metal Binder Jet technology. It is our view that shareholders want actionable, believable value creation plans and are already skeptical of the wildly optimistic management projections underpinning Stratasys’ presentation to investors today. Our combination is founded on straightforward benefits of scale with clear cost synergy estimates that have been jointly reviewed, quickly actionable, and plainly more valuable to shareholders,” continued Dr. Graves.

Dr. Graves concluded, “In our view, it is highly relevant for our investors to understand that the confidence behind our proposal comes from in-depth, prior engagement with Stratasys’ management team. As disclosed today by Stratasys, we have been exploring this combination for the past two years and have tried multiple times, unsuccessfully, to engage constructively with Stratasys’ Board and Management to deliver to both sets of shareholders the benefit of this combination. We, together with Stratasys, evaluated at length the foundational strategic rationale for this combination, including estimated cost synergies of at least $100M, which were previously identified by members of management of both companies during meetings in September 2022. We feel the overwhelming merits of our proposed combination were mischaracterized by Stratasys in its rejection of our proposal and we believe the Stratasys Board should have concluded that our bid was a ‘Superior Proposal’ or at the very least concluded that our bid would reasonably be expected to result in a ‘Superior Proposal,’ under the terms of the Desktop Metal merger agreement. That said, we remain flexible and are open to engaging in productive discourse with the Stratasys Board in pursuit of a friendly, negotiated transaction. We continue to consider all of our options to make this combination a reality.”