While Zeda was seen as a completely healthy company at the beginning of the year, the split between its healthcare and medical activities and its aerospace activities was a sign that there were troubles in that paradise. This is confirmed today, as New Mill Capital, a national asset disposition firm, shared that the company’s machine park will be put up for auction in January.

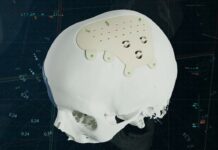

The auction would concern the division in charge of its Aerospace and Defense activities; and include several 3D printers (among which 4 Velo Sapphire 3D Printers, 4 AddUp FormUp 350 L-PBF Machines, Addiblast-Ferro ECOBlast Metal Additive Removal System, Makino, DGM Mori and Tsugami CNC HMCs).

What’s shocking the most the industry is that the announcement occurred after the company raised almost $60 million in series B last year.

I believe the simple analysis somehow came from a lesson I learned from my grandma: money makes blind. Used properly it makes something beautiful; used in a wrong way, it makes a mess.

Following this funding round, Zeda moved to new headquarters and acquired the Orthopaedic Implant. No commercial partnerships that would have suggested the company has been making a lot of money behind, have ever been announced after that.

Added to that existing legal challenges, the company was moving toward a grey future where its relationships with suppliers and partners were impacted. Furthermore, it’s today the company’s reputation among current and prospective investors which is on the balance as they are now monitoring whether Zeda can navigate its current troubles.

Zeda’s assets will be put up for auction on January 15th.

Remember, you can post free-of-charge job opportunities in the AM Industry on 3D ADEPT Media or look for a job via our job board. Make sure to follow us on our social networks and subscribe to our weekly newsletter: Facebook, Twitter, LinkedIn & Instagram! If you want to be featured in the next issue of our digital magazine or if you hear a story that needs to be heard, make sure to send it to contact@3dadept.com.