Reviewing 2025 often comes down to taking a critical look at the companies that have consistently kept the industry on its toes. One such company is 3D Systems. From technology updates to thought leadership across several verticals, 2025 was anything but a snooze fest for the additive manufacturing giant.

Although very little was communicated about 3D Systems’ broader strategy early in the year, 2025 ultimately revealed a company steadily advancing its AM solutions across four key segments:

- Healthcare and dental

- Motorsports, foundries, and service bureaus

- Jewelry

- Aerospace, space and defence

Healthcare & dental

Healthcare continues to be one of the strongest drivers of additive manufacturing adoption, posting double-digit growth and reaching multi-billion-dollar scale; now rivalling aerospace and automotive in both impact and maturity. It is therefore unsurprising to see AM players deepening their technical capabilities to address the very specific demands of this sector.

Digital dentistry remains one of the most established application domains, and 3D Systems’ extensive portfolio of integrated solutions continues to support dental laboratories and clinics in producing patient-specific devices.

This year, the company upgraded its NextDent® Jetted Denture Solution for multi-material monolithic dentures, which is now commercially available in the U.S. market. At the heart of this solution is the NextDent® 300 MultiJet 3D printer, a system designed for rapid production of fully cured, patient-specific dentures that require no additional post-curing steps.

The hardware update is complemented by the introduction of new materials such as NextDent® Jet Teeth and NextDent® Jet Base. These materials are engineered for applications like night guards, a segment experiencing growing demand among dental professionals.

Additionally, 3D Systems’ portfolio of clinically validated NextDent 3D printing resins now addresses more than 30 applications, including those focused on repairing teeth. This includes materials such as NextDent C&B MFH (Micro Filled Hybrid). This material has been developed for crowns and bridges, and engineered to efficiently produce strong, durable patient-specific devices.

Beyond dentistry, 3D Systems remains one of the few companies actively advancing 3D bioprinting technologies. The company marked a major milestone this year with FDA approval for the regenerative repair of peripheral nerve damage.

This approval also represents a win for TISSIUM, the French medtech company partnering with 3D Systems to develop a bespoke 3D printing solution for repairing damaged peripheral nerves. TISSIUM brings to the table its expertise in biomorphic programmable polymers and 3D Systems, its regenerative medicine bioprinting technologies. The outcome is COAPTIUM® CONNECT with TISSIUM Light, a fully bioabsorbable, 3D-printed medical device that leverages a unique photopolymer to support nerve repair.

That said, as the industry continues to evolve in a “virtuous circle,” where applications drive technology advancements, we can’t help but shed light on the 3D-printed PEEK facial implant manufactured at the point-of-care using 3D Systems’ EXT 220 MED.

Made in collaboration with the University Hospital Basel (Switzerland), this implant would be the first MDR-compliant facial implant completed using Evonik’s VESTAKEEP® i4 3DF PEEK on 3D Systems’ EXT 220 ME and used as part of a successful surgery completed at the hospital on March 18, 2025.

This application reinforces what we have been advocating for years: that meaningful progress in medical AM does not come from materials or machines alone, but from the convergence of biocompatible polymers, production-capable hardware, and clinical teams willing to integrate AM directly into patient care.

| Read more in this FOCUS: Empowering medical device manufacturers with competitive advantages to deliver the new generation of PEEK spinal implants |

Motorsports, foundries, and service bureaus

The common thread between motorsports, foundries, and service bureaus is their use of AM for rapid prototyping, lightweight high-performance parts, and on-demand production.

Across these sectors, however, some nuances emerge: motorsports relies on AM for speed and performance gains, foundries leverage it for tooling and casting optimization, and service bureaus act as the backbone enabling companies without in-house resources to access advanced AM capabilities.

In 2025, 3D Systems put particular emphasis on the capabilities of its SLA portfolio for these industries. The company’s SLA 825 Dual is its most advanced large-frame printer to date.

Interestingly, large-format 3D printing is often celebrated through other technologies: LPBF, DED, and even FFF. While SLA may still be far from matching the massive build volumes of DED systems, it is encouraging to see resin-based manufacturers increasingly exploring large-format applications. To us, this is a sign that the market is shifting toward applications requiring high accuracy and surface quality at scale.

With a new 20% larger build volume of 830 × 830 × 550 mm, a dual-laser architecture, and a simplified workflow, we’re eager to see how the SLA 825 Dual will deliver long-term value and scalability for its users. And with 3D Systems’ nearly 40 years of leadership in high-throughput SLA manufacturing, we expect the SLA 825 Dual to deliver on that legacy.

| Read more in this Focus: Reducing delivery times by up to 75% with a decentralized, IP-secure remote spare parts printing solution |

Jewelry

Jewelry remains one of the sectors where AM is reshaping centuries of craft traditions. We have seen this year that when aesthetics meet technology, the result is new levels of luxury, artistry, and craftsmanship with materials once deemed unworkable.

In 2025, the AM solutions provider added the MJP 300W Plus to its portfolio of solutions for jewelry manufacturing. This device could print extremely intricate wax patterns, which are used for the casting of precious metal jewelry.

The 3D printer can be used with the company’s VisiJet® 100% wax materials to achieve new designs, more efficiently, with greater design freedom. According to 3D Systems, this design freedom comes with lower manufacturing costs due to reduced loss of gold or other precious metals during final polishing.

Although jewelry remains a very niche market compared to other verticals, its need for ultra-detailed, high-quality production ensures it remains a strategic segment for 3D Systems’ resin-based portfolio.

| Read more in this Focus: From print to pour: Choosing between wax and resin for jewelry casting patterns |

Aerospace, space, and defence

In these core drivers of AM adoption, 3D Systems’ technology is continuously put in action: on two projects sponsored by NASA, conducted in collaboration with researchers from Penn State University and Arizona State University.

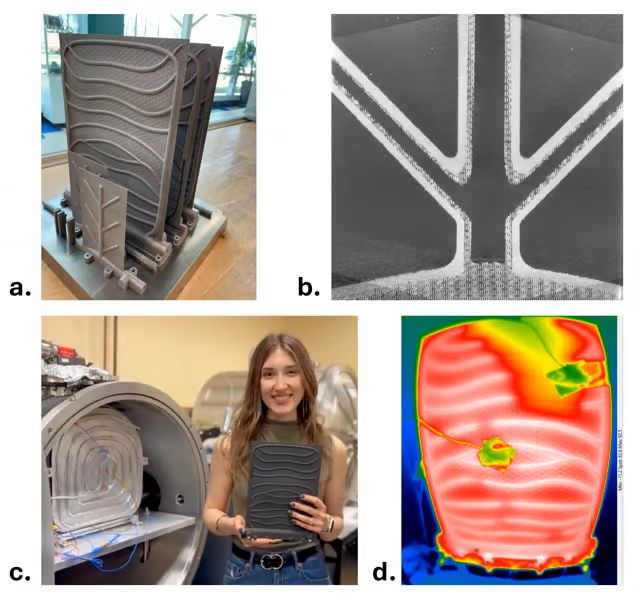

In the first project, 3D Systems’s DMP technology additively manufactured in titanium embedded high-temperature passive heat pipes in heat rejection radiators.

These heat pipe radiators are 50% lighter per area with increased operating temperatures compared with current state-of-the-art radiators, allowing them to radiate heat more efficiently for high power systems.

In the second project, the company’s metal 3D printing was used to develop a process to additively manufacture one of the first functional parts using nickel-titanium (nitinol) shape memory alloys that can be passively actuated and deployed when heated.

Thermal management has quietly become one of the most influential drivers of metal AM adoption, particularly as spacecraft, satellites, and high-power propulsion systems grow more compact and generate significantly more heat. Therefore, it’s not surprising to see 3D Systems’ DMP platform as a strong production solution for next-generation thermal control architectures.

What will be worth watching in the coming year is how the company expands its materials portfolio and process capabilities to meet the growing demand for multifunctional components on the one hand. On the other hand, how quickly these research-driven advancements can be translated into scalable production workflows, especially as aerospace primes and space companies push for higher throughput and qualified material processes.

“3D Systems sees Aerospace and Defense as a key vertical. We have seen significant growth in this sector in 2023, 2024, and now 2025.

We continue to partner with key customers to develop production applications and to grow our business in this area. A few examples that are already public include our recent award from the United States Air Force to support the development of a new, large-scale laser powder bed fusion system.

Another recent example is the release of our new SLA 825 at Formnext. Our SLA systems are used extensively in Aerospace & Defense for wind tunnel test models, jigs, tools, and fixtures, but especially for creating investment casting patterns. This newer system can handle larger components and is more productive.

It is complemented by the recent release of our newest antimony-free resin material for casting patterns (Accura SbF). This material is especially suited for casting patterns for reactive materials like Titanium. We have also been supporting a lot of customers on naval applications, especially with metal laser powder bed fusion for CuNi30, which we were the first to release in 2022,” 3D Systems’ VP Mike Shepard comments.

So, what can we expect from 2026?

3D Systems’ 2025 product development roadmap revealed that the company did not focus on multiplying platforms, but on deepening the ones that already prove value in regulated environments: dentistry, patient-specific devices, aerospace, and space.

Defense is poised to remain a key driver of the AM market, as evidenced by our recent presence at Formnext 2025 and our year-in-review dossier suggests. We therefore expect it to be a strategic vertical for 3D Systems’ next year.

That said, there are other drivers that Shepard sees for AM adoption:

“New designs with high complexity and/or high levels of unitization – in these applications AM may be the only method that can create the desired component. Design utilizing AM can reduce weight, size, and/or increase performance. For AM, you can get an enormous benefit if you can start with a “clean sheet of paper” design.

Supply chain challenges – Long lead times and low to moderate volumes – For aerospace and defense applications AM can really act to streamline supply chain or act as an alternative when suppliers no longer exist or are not interested in low-volume business. In some naval applications with one-to-two-year lead times (CuNi30 castings) one can print a CuNi30 part in one of our LPBF systems in less than a week.

AM is becoming a more mature and accepted manufacturing method. As AM methods have matured, the processes and materials have become more robust, and many organizations have developed the best practices and engineering skills to be able to utilize AM more effectively. This factor is important, but represents a decreasing barrier to entry rather than a direct driver of adoption.”

Featured image: 3D Systems at Formnext 2025 | Credit: 3D Systems

*This Focus has first been published in the 2025 November/December edition of 3D ADEPT Mag. Read our complete end-of year review series here.