“The number of 3D printers you have does not tell the full story”

If I had to pass an exam where I am asked to list 5 key industries where Additive Manufacturing (AM) is unstoppable, Automotive will definitely be part of my list. Surprisingly, in the short list of car manufacturers who are betting on AM, not all of them truly succeed in saving millions through this technology. Ford is an exception here and the more I learn about this company, the more I realize that its adoption curve across different regions involves different capacities and purposes.

If you are a regular reader of 3D ADEPT Media, you may already know that Ford’s AM activities sometimes go beyond the production of 3D printed accessories and parts for its vehicles to involve technology partnerships with 3D printing OEMs. A closer look at our coverage reveals that most of the company’s activities covered so far are related to operations held in North America –3D ADEPT being a global trade press.

Nevertheless, with more than 60% of our readership based in Europe, one question that may easily come to anyone’s mind is: What’s the strategy behind Ford’s adoption of AM? Or like I said in the beginning, how does Ford succeed in saving millions through AM?

An innovation strategy based on 6 pillars

If Ford has been using AM for several years, the company attracted attention when its Valencia-based plant started adding SLA 3D printers to its fleet of 3D printers. At the time, in 2021, we knew the short-term goal was to manufacture plastic caps used in vacuum tests to test for engine leaks.

“[Our 3D printing journey] starts with trial activities. Valencia was the first plant where we have a 3D printing center and what we did here was copied all over Europe and globally,” Rene Wolf, Managing Director of Manufacturing at Ford-Werke, told 3D ADEPT Media. “In 2022, we established an EU Innovation Team that defined 6 key pillars on which we should focus our strategy. Those pillars include vision systems, robotics, digitization, big data, automated vehicles and obviously Additive Manufacturing. With AM as one of our key innovation pillars, we wanted to come out of a niche with better applications.”

For this reason, Ford’s ultimate goal was not to achieve mass production – at least not at the time -, but to exchange knowledge and share 3D printable designs between experts across different locations; and later on, gradually implement a system for parts digitalization.

For this reason, Ford’s ultimate goal was not to achieve mass production – at least not at the time -, but to exchange knowledge and share 3D printable designs between experts across different locations; and later on, gradually implement a system for parts digitalization.

With Valencia selected as a pilot project to ensure a smooth rollout across the EU region, the first seeds of this strategy were observed 18 months later, with the opening of the Cologne Electric Vehicle Center.

AM at the Cologne Electric Vehicle Center

February 2023: Ford announced the transformation of its production facilities at Cologne with the goal of driving digitization and industry 4.0. Most people (including myself) who hear about the establishment of a 3D printing center would be quick to ask: “What does the production environment look like there?”. To that question, Wolf answers:

“About 24 3D printers in the center and additional 3D printers in key areas of the plant.” And then he adds: “The number of 3D printers you have does not tell the full story.”

For Wolf, one may have different 3D printers based on the same technology, or different 3D printers for different applications but what matters is the way you use them. With AM especially, different technologies are pivotal to scale one’s production roadmap, he explains.

Ford’s 3D printers are based on FDM, SLS, SLM and SLA. The FDM 3D printers include machines from the likes of Markforged, Weber, Bambu Lab, BigRep, UltiMaker, and Creality; the SLS machines are coming from Formlabs, SLA from Anycubic and SLM from Aconity. In Valencia and in the UK, Ford also has other 3D printers available.

With the opening of the Cologne Electric Vehicle Center, the car manufacturer established “3D printing Key Performance Indicators” that aimed to save a seven-digit number per year and per site (Cologne and Valencia).

With the opening of the Cologne Electric Vehicle Center, the car manufacturer established “3D printing Key Performance Indicators” that aimed to save a seven-digit number per year and per site (Cologne and Valencia).

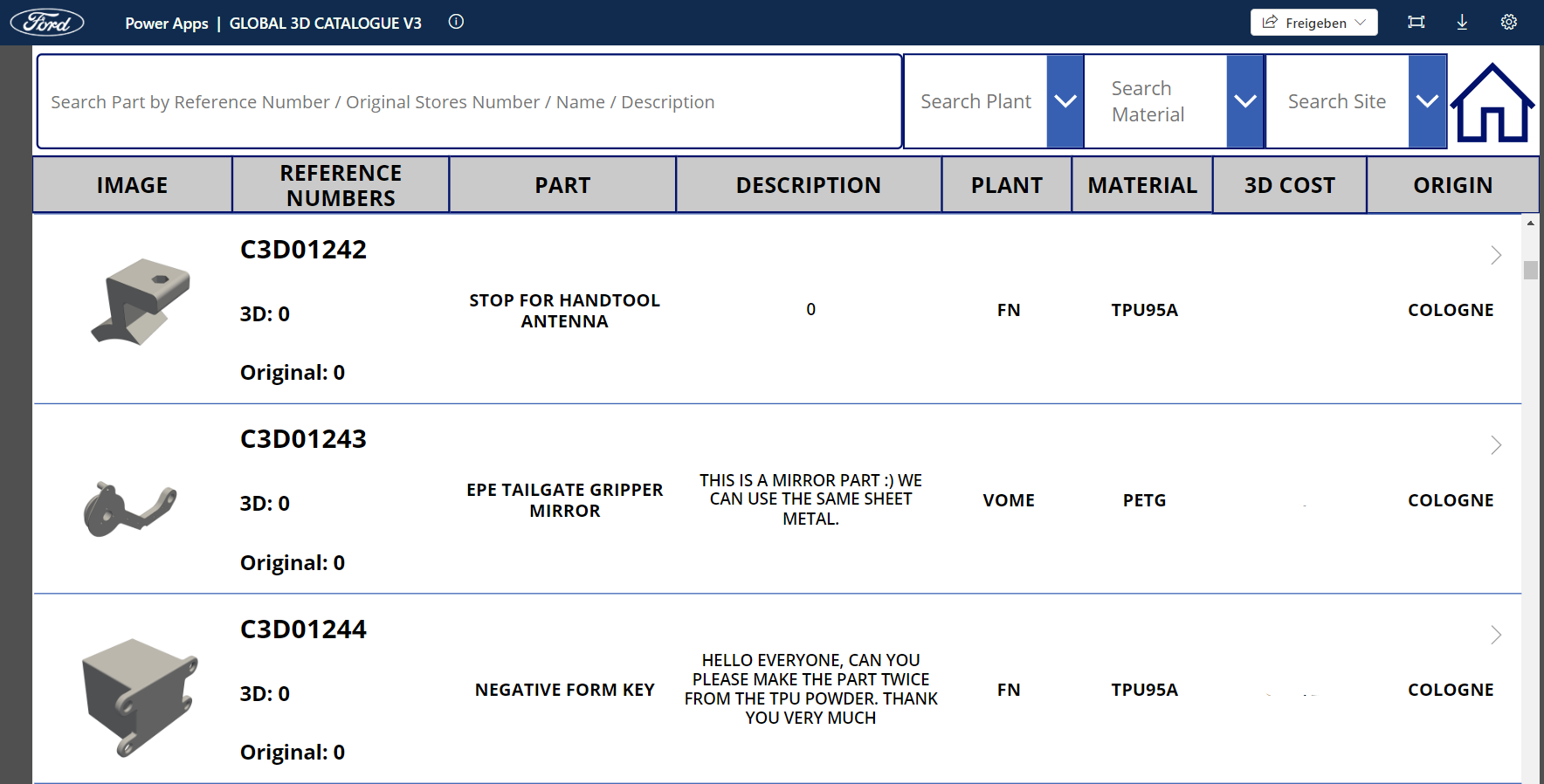

One initiative the company prides itself on is the development of a digital inventory for spare parts and special parts for jigs and fixtures. “The online catalog is used across different plants and enables our teams to save both time and money. With this catalog, each plant does not have to develop its own process. They would just copy the digital models and adapt them to their needs,” he points out.

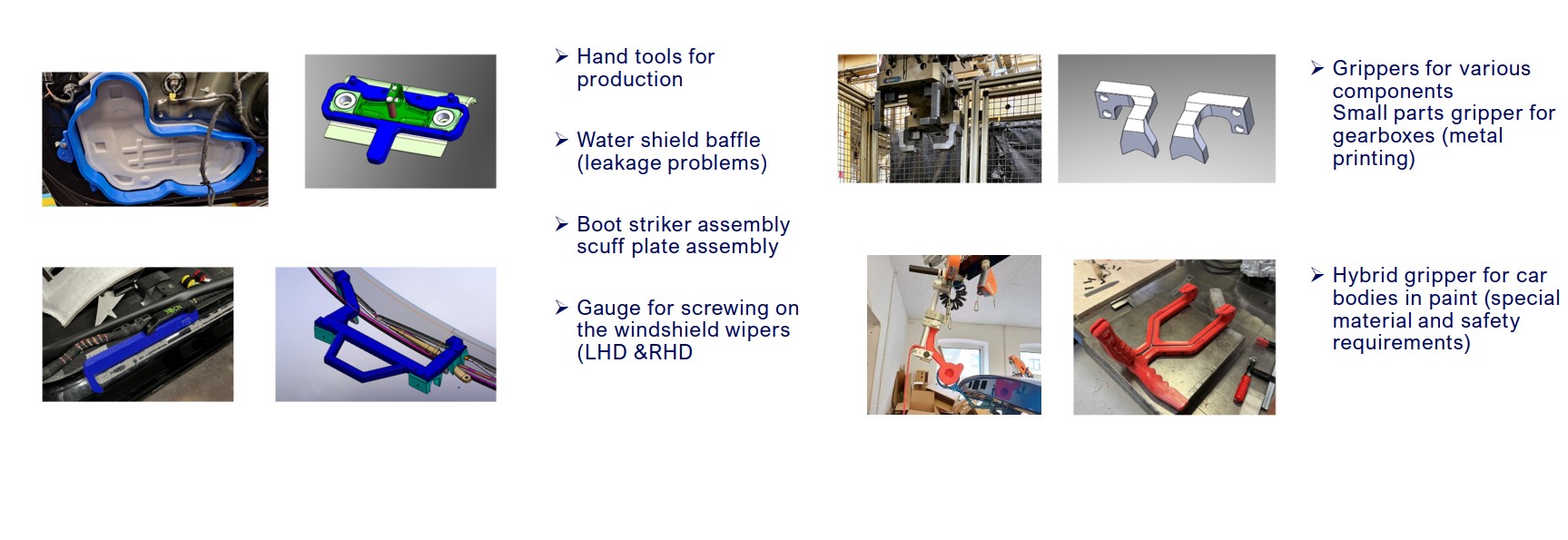

In practice, the 3D printing center of Cologne has produced over 20,000 parts since its opening in 2023. A few production cases that recently kept the team busy include hand tools for production, a water shield baffle, a boot striker assembly, a gauge for screwing on the windshield wipers, grippers for various components, and hybrid grippers for car bodies.

Over time, the company embarked on some EU innovation activities and has been working closely with the US team since 2023.

Over time, the company embarked on some EU innovation activities and has been working closely with the US team since 2023.

What about electrification?

When Ford opened the Cologne 3D printing center, it said it wanted to support the production of its first all-electric mass production vehicle built in Europe. Although electrification is at the heart of conversations among OEMs and politics, AM’s role here is still subject to debate.

As a matter of fact, the HaPiPro2 project (where Ford was involved as a partner), that ambitioned to investigate new production processes for the next generation of electric motors, stopped for several reasons. One of the reasons is that “AM cannot be used for mass production purposes in such context. That’s why for electric components that will constitute automotive parts, we are not considering AM yet,” Wolf explains.

That being said, Ford is currently exploring the use of AM for the development of copper terminals used on e-motors in collaboration with Birmingham University. Another project includes the use of AM for the development of e-motors for line trials and packing trials.

And today?

Valencia and Cologne may be at the forefront of Ford’s innovation strategy, but this strategy is gradually being rolled out across other EU plants. By decentralizing 3D printing equipment in all maintenance areas across the continent to handle emergency actions and prototyping of first ideas under the guidance of 3D printing experts, Ford 3D printing centers will enable the company to save costs and avoid external production support.

In addition to Valencia and Cologne, other 3D printing centers in Europe include Dagenham, Halewood, Saarlouis, Merkenich and Dunton.

In the long run, and from a technology standpoint, the company believes that a faster adoption of AM processes can be achieved if testing and validation methods are standardized, if cycle times are faster, and if there are better control features of the printing process.

This content was initially published in the July/August edition of 3D ADEPT Mag.