No one is very good at consistently getting market forecasts right. As a matter of fact, every time we tried, we were surprised by the turn of events. However, one thing is certain, at the end of each year or at the end of a given period or event, we should be able to sit down, reflect and draw lessons from what has worked and what still needs to be improved.

With that in mind, we asked a simple yet revealing question to industry experts: ‘What lessons did you take away from the AM market this year?’ From VC advisors to associations and AM specialists, their insights offer a multifaceted view of the market’s successes and ongoing challenges.

Frank Carsten Herzog, Founder and Managing Director of the VC firm HZG Group

For many start-ups in the 3D printing industry, it has become more difficult to find capital for new financing rounds. As investors, we no longer encounter exaggerated valuations as often as we did three years ago. The self-perception of start-ups is becoming more realistic.

For many start-ups in the 3D printing industry, it has become more difficult to find capital for new financing rounds. As investors, we no longer encounter exaggerated valuations as often as we did three years ago. The self-perception of start-ups is becoming more realistic.

Overall, the 3D printing market is growing. But a differentiated view is needed to identify specific growth opportunities. Because there is no such thing as the one AM market. Nor is there a single key to technological advancements success. All players are called upon to extend or maintain their current leading positions through a constant willingness to innovate.

We will only be able to realize the full potential of 3D printing and other future technologies with an education system that introduces children to technology topics from an early age.

Tali Rosman, Business Advisor

Working with both AM innovators and AM investors & acquirers, I got to experience 2024 from all sides of the industry.For investors and acquirers, the ghosts of failed SPACs and overhyped funding rounds still loom large, leaving behind write-offs and SPACs trading like penny stocks. Understandably, investors have become cautious—perhaps too cautious. The pendulum has swung so far toward risk aversion that I’ve seen good deals—companies with solid fundamentals and real traction—struggle to attract attention. It’s the classic overcorrection: once you get burned, even lukewarm feels like boiling.

Working with both AM innovators and AM investors & acquirers, I got to experience 2024 from all sides of the industry.For investors and acquirers, the ghosts of failed SPACs and overhyped funding rounds still loom large, leaving behind write-offs and SPACs trading like penny stocks. Understandably, investors have become cautious—perhaps too cautious. The pendulum has swung so far toward risk aversion that I’ve seen good deals—companies with solid fundamentals and real traction—struggle to attract attention. It’s the classic overcorrection: once you get burned, even lukewarm feels like boiling.

For innovators, this pendulum swing is understandably frustrating. Early-stage companies are (finally) emphasizing product-market fit and disciplined financial behavior, but the pace of investors returning to the table remains slow. In my view, while skepticism is certainly warranted, overplaying it risks leaving real opportunities on the table just as the market begins to stabilize.

And the market is stabilizing, especially in the U.S. (when compared to Western Europe). One key driver is the Department of Defense (DoD), which has been accelerating AM adoption. As I covered in a report I published earlier this year on the DoD’s use of AM, more applications are emerging in the defense sector. When coupled with the broader manufacturing reshoring trend, this creates significant potential for our industry moving forward. So, while 2024 has been quite the ride, 2025 is shaping up to be a year of renewed momentum and opportunity.

Tuan TranPham, President, Anisoprint (Americas & Asia Pacific)

What is happening now is really needed, as in there needs to be a clean-up and consolidation. But, for 3D printing to further grow, the synergy with the other components of the 4th Industrial Revolution is a must. This includes a synergy with Robotics, OiT, Automation, big data, AI machine learning, and sensors.

What is happening now is really needed, as in there needs to be a clean-up and consolidation. But, for 3D printing to further grow, the synergy with the other components of the 4th Industrial Revolution is a must. This includes a synergy with Robotics, OiT, Automation, big data, AI machine learning, and sensors.

On another note, the market is growing across all geographical areas. And with the growing presence of companies based in India, Korea, Taiwan, and Japan on the international scene, we have to keep in mind that beyond copy-cats, there are vendors with new innovations too.

Kate Black, Founder & CEO of Atomik AM

This year, while the AM market has slowed considerably, I think there have been glimmers of hope. The market is starting to realize that its survival depends on doing things differently. One key lesson that people are seeing is that we need an overhaul in how we approach materials, with more attention to innovation and collaboration in this space. Companies like Additimetal, focusing purely on machines, or Amazemet, working with customers to develop bespoke powders, are great examples. My own company Atomik AM has been focusing on binders that synergistically work with powders and print heads so that we can create robust binder solutions for all customers. These organizations show the value of doing one thing exceptionally well and then working together to create an ecosystem that delivers exactly what customers need. I think the real magic of AM lies not just in printing complex geometries but also in creating parts with bespoke materials and functionalities and the industry is starting to see this. It’s this kind of collaboration and specialists working together to push boundaries, that will lift the AM market from its current challenges. With this mindset, I think AM has the potential to rise stronger and shine again.

This year, while the AM market has slowed considerably, I think there have been glimmers of hope. The market is starting to realize that its survival depends on doing things differently. One key lesson that people are seeing is that we need an overhaul in how we approach materials, with more attention to innovation and collaboration in this space. Companies like Additimetal, focusing purely on machines, or Amazemet, working with customers to develop bespoke powders, are great examples. My own company Atomik AM has been focusing on binders that synergistically work with powders and print heads so that we can create robust binder solutions for all customers. These organizations show the value of doing one thing exceptionally well and then working together to create an ecosystem that delivers exactly what customers need. I think the real magic of AM lies not just in printing complex geometries but also in creating parts with bespoke materials and functionalities and the industry is starting to see this. It’s this kind of collaboration and specialists working together to push boundaries, that will lift the AM market from its current challenges. With this mindset, I think AM has the potential to rise stronger and shine again.

Martin Back, CEO of Forward AM

This year, the additive manufacturing (AM) industry moved from inflated expectations to practical applications, focusing on customization, digitalization, and efficiency. Chinese companies are leading this shift, leveraging AM systematically to accelerate innovation cycles and embed it as a standard industrial process. Western firms, noticing this “Chinese Speed,” are seeking tangible solutions to regain competitive confidence. Educational efforts by companies like MakerBot and Ultimaker have also paid off, with a new generation of decision-makers integrating AM into supply chains. Meanwhile, firms like Bambu Lab are democratizing 3D printing, broadening accessibility and fostering deeper adoption. As global competition intensifies, collaboration across regions and sectors is crucial. Only by combining expertise can AM fully establish itself as a cornerstone of modern manufacturing strategies.

This year, the additive manufacturing (AM) industry moved from inflated expectations to practical applications, focusing on customization, digitalization, and efficiency. Chinese companies are leading this shift, leveraging AM systematically to accelerate innovation cycles and embed it as a standard industrial process. Western firms, noticing this “Chinese Speed,” are seeking tangible solutions to regain competitive confidence. Educational efforts by companies like MakerBot and Ultimaker have also paid off, with a new generation of decision-makers integrating AM into supply chains. Meanwhile, firms like Bambu Lab are democratizing 3D printing, broadening accessibility and fostering deeper adoption. As global competition intensifies, collaboration across regions and sectors is crucial. Only by combining expertise can AM fully establish itself as a cornerstone of modern manufacturing strategies.

The Mobility Goes Additive – Mobility and Medical Team.

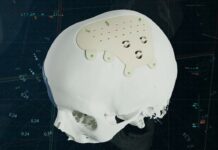

As the leading international network for additive manufacturing, our reflection on 2024 lessons reveals both promising developments and concerning challenges in the AM market. We see consumer applications in design, lifestyle, and fitness sectors gaining visibility through the retail presence and personalized products; the healthcare sector is advancing with patient-specific devices and increased adoption across hospitals; and the defence sector maintaining strong AM implementation across European armies, though standardization remains crucial. However, the market growth has been slower than anticipated, and adoption isn’t as widespread as it should be. Notably, well-structured companies with reliable products have often outperformed heavily marketed venture-backed companies. Material qualification and knowledge persist as a challenge, with new materials entering the market faster than our understanding of existing materials’ long-term performance. Specifically for AM medical applications, there is a vital need to establish standardized quality, regulatory, and reimbursement systems. Formnext 2024 confirmed AM’s establishment in large enterprises and highlighted the untapped potential in SMEs. It also showcased innovations with great potential for transfer in healthcare and public transport sectors. Current economic challenges, suggest the need for measured industry development. At this point, we should take a deep breath and jointly tackle all the unadopted areas with continuity and trust. It could be that the Facebook motto of “move fast and break things,” coined by Mark Zuckerberg, does not work in engineering. Our network emphasizes that successful AM market advancement depends on collaborACTion and user-driven knowledge transfer, reinforcing our vital role in bridging expertise and advancing AM capabilities across sectors. We are excited for a 2025 positively impacted by AM.

As the leading international network for additive manufacturing, our reflection on 2024 lessons reveals both promising developments and concerning challenges in the AM market. We see consumer applications in design, lifestyle, and fitness sectors gaining visibility through the retail presence and personalized products; the healthcare sector is advancing with patient-specific devices and increased adoption across hospitals; and the defence sector maintaining strong AM implementation across European armies, though standardization remains crucial. However, the market growth has been slower than anticipated, and adoption isn’t as widespread as it should be. Notably, well-structured companies with reliable products have often outperformed heavily marketed venture-backed companies. Material qualification and knowledge persist as a challenge, with new materials entering the market faster than our understanding of existing materials’ long-term performance. Specifically for AM medical applications, there is a vital need to establish standardized quality, regulatory, and reimbursement systems. Formnext 2024 confirmed AM’s establishment in large enterprises and highlighted the untapped potential in SMEs. It also showcased innovations with great potential for transfer in healthcare and public transport sectors. Current economic challenges, suggest the need for measured industry development. At this point, we should take a deep breath and jointly tackle all the unadopted areas with continuity and trust. It could be that the Facebook motto of “move fast and break things,” coined by Mark Zuckerberg, does not work in engineering. Our network emphasizes that successful AM market advancement depends on collaborACTion and user-driven knowledge transfer, reinforcing our vital role in bridging expertise and advancing AM capabilities across sectors. We are excited for a 2025 positively impacted by AM.

Read more about our 2024 year in review in the November/December edition of 3D ADEPT Mag. Featured image: Christopher Burns via Unsplash.