The Additive Manufacturing community was on fire yesterday on social media – as Covestro has announced sale of its Additive Manufacturing business to Stratasys. The announcement has made a real splash given the fact that Nano Dimension now owns 12.12% of Stratasys and Covestro acquired DSM AM business just last year to expand its portfolio.

In this specific case, the selling price amounts to approximately EUR 43 million. In addition, there is a potential earn-out of up to EUR 37 million, which is subject to the achievement of various performance metrics. With the decision to sell the Additive Manufacturing Business, Covestro continues its portfolio optimization in order to position itself even more efficiently in the market and to be able to place greater focus on its extensive offering for customers in its core industries, the company says in a press release.

At the manufacturing level, we know Covestro has always been a key part of Stratasys’ third-party materials ecosystem which means it is an interesting deal for multiple Stratasys 3D printing platforms.

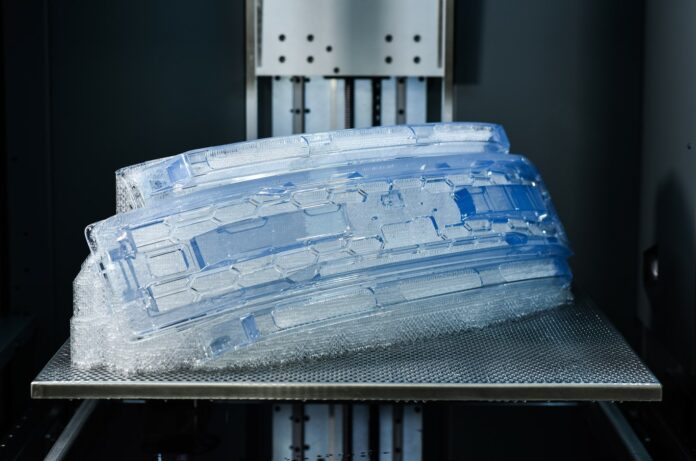

“Innovative materials are the fuel of additive manufacturing and translate directly into the ability to create new use cases for 3D printing, particularly in the production of end-use parts like dental aligners and automotive components,” said Stratasys CEO Dr. Yoav Zeif. “The acquisition of Covestro’s highly regarded Additive Manufacturing business positions us to further grow adoption of our newest technologies. We will now have the ability to accelerate cutting-edge developments in 3D printing materials, and advance our strategy of providing the best and most complete polymer 3D printing portfolio in the industry.”

Covestro’s divested business includes employees, Research & Development facilities, production assets and offices in the Netherlands, Germany, the U.S. and China as well as access to a large network of partners globally. The business offers material solutions for common polymer 3D printing processes as well as Resins & Functional Materials through the brands Somos® and Addigy®.

However, while the Stratasys-Covestro deal is what raised attention the most, it should be noted that material producer Altana decided to sell its stake in dp polar to 3D Systems. Before entering into the details of this agreement, we need to recognize that Altana and dp polar have had a great ride together – a journey that started in 2017 when the specialty chemicals company invested in the business of the machine manufacturer dp polar.

They have invested extra miles to advance the hard-to-understand inkjet 3D printing market. Together, they developed Cubic Ink® 3D printing material families that can be processed on dp polar’s 3D printing systems – the AMpolar® machine generation for material jetting – that they have enhanced together.

Now that 3D Systems has purchased dp polar for an undisclosed price, Dr. Petra Severit, Chief Technology Officer of ALTANA AG believes that [the German developer of inkjet 3D printing] should move ahead to a new growth stage with an industry partner that specializes in 3D printing hardware – 3D Systems -.

On another note, Altana’s customers will continue to benefit from the company’s solution expertise in the development of high-performance materials as well as its experience in the formulation of high-performance inkjet inks.

Those deals being reported, let’s say this wave of M&A sometimes feels like AM giants are playing the ball.

There are tons of reasons that can explain why companies sell their business but the AM market is really one of a kind – therefore speculation is well underway. When we look at the deals between Desktop Metal and ExOne, Protolabs and Hubs, BEAMIT and 3T Additive Manufacturing and the ones that we shared above, is it fair to think that the AM market is consolidating to a small group of major players?

One thing is certain right now, is that it is growing – Indeed, each technology comes with its share of pros and cons, and it’s up to the technology developers to find viable ways to address each of the challenges. In dp polar’s case, the need for a 3D printing hardware company is therefore understandable. Furthermore, when a giant acquires a small company, the latter would benefit from strong sales, marketing or distribution which will ultimately lead to overall growth.

Keep in mind that M&A is nothing new to the AM arena. Remember that 3D Systems alone acquired nearly 30 companies total from 2011-2016. It’s just that with the continuous wave of newcomers, we tend to forget that – not to mention that the current giants that have been acquiring small AM companies lately are doing so to enter the AM space.

While there is still a gap between what the industry thinks about itself, what it can do as a whole and how it’s valued – a gap that we believe we as a media – and analysts will help demystify, I would like to keep in mind that M&A remains a great way to gain access to specific know-how which is often tied to entrepreneurs and their company’s culture, a know-how that is ultimate an added-value for the buyer.

Remember, you can post jobopportunities in the AM Industry on 3D ADEPT Media free of charge or look for a job via our job board. Make sure to follow us on our social networks and subscribe to our weekly newsletter : Facebook, Twitter, LinkedIn & Instagram ! If you want to be featured in the next issue of our digital magazine or if you hear a story that needs to be heard, make sure to send it to contact@3dadept.com